Measuring Cost: Which Costs Matter?

Accounting Cost versus Economic Cost

- Accounting Cost

- Actual expenses and adding the depreciation charges for the capital equipment

- Economic Cost

- Cost to a firm of employing economic resources in production, involving the opportunity cost

Opportunity cost.

- Cost associated with opportunities that are foregone when a firm's resources are not put to their highest-value use.

An Example

- A firm has its own building and pays no rent for the space of office

- Does this mean cost of office space is zero?

Sunk Cost

- Expenditure which are made already and cannot be recovered back

- Should not influence firm's decisions.

An Example

- A firm pays $500,000 for option to buy building.

- The cost of building is $5 million or total of $5.5 million.

- The firm finds the other building for $5.25 million.

- Which building should the firm buy?

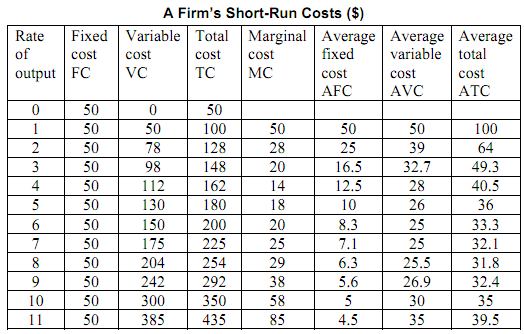

Fixed and Variable Costs

- Total output is the function of variable inputs and fixed inputs.

- Thus, the total cost of production equals fixed cost (cost of the fixed inputs) plus variable cost (the cost of the variable inputs)

- Fixed Cost

- Does not vary with level of output

- Variable Cost

- Cost which varies as the output varies

Fixed Cost

- Cost paid by firm which is in business regardless of level of output

Sunk Cost

- Cost that have been incurred and recovering of it can't be done

?Personal Computers: most costs are variable

- Components, labor

Software: most costs are sunk

- Cost of developing the software

Pizza

- Largest cost component is fixed