The LM-curve in the AS-AD model

|

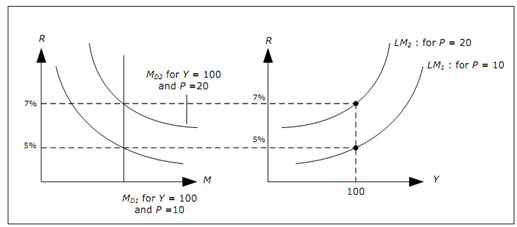

The LM-curve will shift upwards (downward) when P is increases (decreases)

in the AS-AD model is moved

|

LM-curve in the AS-AD model is slightly more complicated as P will affect the demand for money. In IS-LM model, LM-curve is defined as all combination of R and Y where money market is in equilibrium, that is, where demand for money is equal to supply of money, MD(Y, R) = MS.

In AS-AD model, LM-curve demonstrates all combinations of R and Y, where money market is in equilibrium for a given P. For a given P, we may still draw LM curve in the AS-AD model just as we did in IS-LM model. For a given P, there are numerous combinations of R and Y where money market is in equilibrium. Besides for another given P, another set of combinations of R and Y would be associated with equilibrium in the money market. It means that LM-curve will shift when P changes.

Figure: Money market diagram with different prices

1. First consider top left figure. Demand curve for money, MD1 is drawn for Y = 100 and P = 10. Equilibrium interest rate is R = 5%.

2. Y = 100 and R = 5% will provide us with a point on the LM1 curve to the right.

3. Now assume that P increases to 20. We know that demand for money will increase and curve will shift to the right (to MD2).

4. We see that R = 5% and Y = 100 is no longer an equilibrium in money market.

5. To the left you see that R = 7% would be an equilibrium when Y = 100 for P = 20.

6. R = 7% and Y = 100 should be on a new LM curve (LM2) associated with higher price P = 20.

There is an LM curve for P = 10 (LM1) and an LM curve for P = 20 (LM2). The significant thing to remember is that in AS-AD model, there is one LM-curve for each value of P. When P increases, LM curve will shift to a new curve that will be above the old one. Reason, again, is that R should increase when P increases to keep the money market in equilibrium.