In February 19_8, Randy White, president of XYZ Corporation (XYZ), had just received two requests for a price on two of their marble products. The first request was from a nearby city for 140,000 square feet, or approximately 2,000 tonnes, of paving stones. The second request was from a construction firm in Ohio, which requested a price on 3,000 tonnes of windowsills of varying sizes. While White was confident that a price of $300 a tonne for the paving stones and $500 a tonne for the windowsills would result in XYZ receiving the orders, he was unsure that these prices would result in a reasonable profit.

Company Background

XYZ was established in Cambridge, Ontario in 1949 by E. B. Ratcliffe, a chemical engineer, to produce precast stones. In 1956, he developed a unique worldwide process that compressed sand into stone without the use of cement. The result was a stone that was more durable than the normal clay bricks or other masonry products and that could be formed into a variety of shapes, sizes, colours, and textures.

In 1962, XYZ added a second product line that involved the cutting of limestone blocks from a quarry near Wiarton, Ontario and the production of marble hearth slabs and windowsills in Cambridge. In 1980, additional marble products, of paving stones and building stones, were added to the line. These marble products are sold under the trade name Adair Marble.

As of 19_8, the company was the only producer of the manufactured stones in the world and was Canada's largest producer of marble products, with only one smaller competitor located in Winnipeg, Manitoba. Recently XYZ had been successful in obtaining some significant contracts that included supplying the marble stone for the Canadian Chancery in Washington, the Ontario Court House and Registry Office in Ottawa, and the reconstruction of the Rideau Canal locks. With these and other contracts, XYZ had established a reputation among architects and contractors as a leading producer of unique and top-quality stone products.

White had been with the company for nine years, after graduating from Queen's University with a degree in commerce and obtaining his Chartered Accountant designation. During his nine years, White held the positions of controller, executive vice-president, and president. With this experience, he was fully aware of both the financial and the technical implications of the various alterna-tives that he faced. In particular, he was acutely aware that the variability of the yields and product mix significantly complicated any analyses of product line profitability.

Production Process

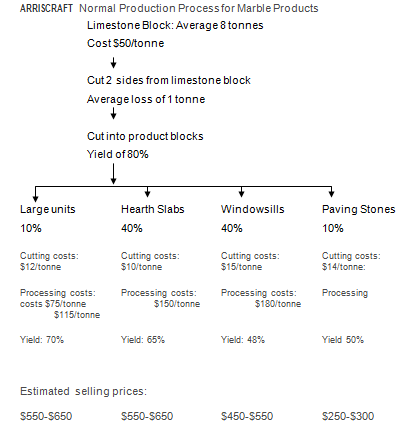

As the decisions facing White concerned marble products, only the production process related to these products will be described. Exhibit 1 illustrates the fol-lowing description of this process.

First, limestone blocks are drilled and cut from a quarry. The top surface of the quarry is the side of the block; the dimensions are 30 inches by 84 inches. The depth of the block will vary depending upon the natural bed depth of the quarry, but lengths vary from three to ten feet. The net result is limestone blocks that vary in size from four to twelve tonnes, with an average size being approximately eight tonnes. These limestone blocks are then trucked to XYZ's plant. The total direct cost of the limestone blocks is approximately $50 per tonne, which includes the removal and transportation costs.

At the plant, each limestone block is positioned in front of a saw, which first cuts off two sides. These cuts will remove approximately one tonne of waste from an average eight-tonne block, leaving seven tonnes. Next, the saw operator must make a series of critical judgment calls as he or she cuts the limestone block into slices called product blocks. The saw operator must examine the face of the stone for cracks, pits, or other faults. If any are found, a cut approximately eight inches wide will be made and the product block will be further processed into paving stones. If the limestone block is reasonably clear of faults, then a six-inch cut will be made and the product block will be produced into windowsills. If the stone is of highest quality, then cuts varying from 6 to 30 inches will be made to produce specialized products and hearth slabs. A fourth product line is referred to as larger units, where the quality may be low and these sections would otherwise be used for paving stones. However, if a wider cut is made, the stone can be used in place of some top-quality large pieces for some specific applications. The skill of the saw operator is extremely important, as a limestone block will normally produce many grades of products, and thus a judgement call is required after each cut is made. The cutting of the limestone block into product blocks results in an 80% yield of the seven tonnes, and the cutting costs per tonne of product block vary for each of the four product lines as follows:

Large units: $12/tonne

Hearth Slabs: $10/tonne

Window Sills: $15/tonne

Paving stones: $14/tonne

While a variance of 10 to 15 % exists, it is expected that 10% of the product block tonnage will be in paving stones, 40% in windowsills, 40% in hearth slabs, and 10% in large units.

The processing of the product blocks into their designated final products first involves some additional sawing and splitting. Then, depending upon the quality of the final product, the stones are honed (smoothed) to produce the marble product. The extent of the processing varies by product line and the ultimate yield will also vary by product line. The paving stones have a 50% yield and the processing costs total $115 per tonne of finished product. The windowsills have a yield of 48 % with a processing cost of $180 per tonne of finished product. The waste from the windowsills can be used for paving stones, and after a further processing cost of $65 per tonne of finished product, a yield of 21 % of the waste is obtained. The hearth slabs are processed for a cost of$150 per tonne of finished product, which is a 65% yield of the product blocks. The large units result in a yield of 70% for a processing cost of $75 per finished tonne.

The above description is the typical production process; however, it is possible to produce paving stones and windowsills from higher-grade' material. While the cutting and processing costs for the paving stones and windowsills would remain the same, the yields would increase.

Situation Summary

White had been faced many times with similar situations like those before him now. If 2,000 tonnes of paving stones are produced by means of the normal production process, more than the required quantities of windowsills must also be produced. Furthermore, product blocks that will eventually be produced into hearth slabs, and large units must also be cut even though they are not currently required. However, if the limestone blocks were cut into only paving stones, only windowsills, or both paving stones and windowsills, the higher-quality material would be used where lower-quality material would meet the customer requirements. The market for these marble products was somewhat unpredictable, as the orders tended to be large and depended essentially upon the preferences of an architect or contractor. While XYZ did not have any direct competition, the small amount of competition came from less expensive alternative building products. For example, the paving stones will cost the city $4.29 a square foot, whereas interlocking brick (an alternative, cement-based product) would cost $1 to $2 a square foot. The issue is essentially how much more the market is willing to pay for a marble product than a more common alternative.

Given the common costs of the limestone block and the cutting, White again wondered whether a price of $300 per tonne of paving stones and $500 per tonne of windowsills would generate sufficient profits. As a rule of thumb, the company has historically attempted to attain a markup of 100% on the direct product costs. Typically, a markup of less than 70% was viewed as unprofitable. However, in a situation such as this, the measurement of the direct costs by product line is not straightforward. Furthermore, the unsold product, both finished and unfinished, had always presented a problem when costing the inventory for XYZ's annual financial report. Depending on the approach adopted the costing of the inventory could have a material effect on the net income.

Required

As Randy White would you bid on these two orders, and if so, at what price? Explain your reasoning. Prepare your answer in good "Case" format.