Q. How are LIBOR, TIBOR and EURIBOR determined?

London Inter Bank Offered rate (LIBOR) and is the rate of interest at which banks offer funds to other banks in marketable size in the London interbank market. It is the primary benchmark utilized by banks, securities houses and investors to fix the cost of borrowing in the money, derivatives and capital markets around the world. LIBOR refers to any of a number of short-term indicative interest rates compiled by the British Bankers Association (BBA) at 11:00 AM London time, each business day. LIBOR is quoted for one-week or two-week and monthly maturities up to a year for many of the world's currencies (US Dollar, Euro, Yen, Swiss Franc, GB Pound, Canadian Dollar, and Australian Dollar) in addition to spot/next (but overnight for EUR, GBP, USD and CAD).

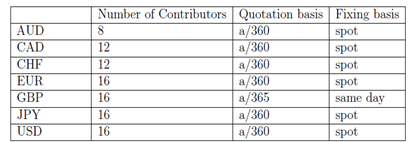

All currencies are fixed on a spot foundation on each London Business Day apart from GBP which is fixed for same day value.

LIBOR fixing developed in the early 1980's with the growth of syndicated lending and early developments in the derivative markets. Since it has supposed an increasing importance. It is usually acknowledged as a truly international benchmark. BBA LIBOR is published concurrently on more than 300000 screens throughout the world.

The numerous contributing banks quotation foundation and fixing basis for every currency is given in the following table.

The Euro BBA LIBOR Panel banks are selected on the basis of market activity perceived market reputation and expertise in the particular currency and are surveyed for their views of the market rate. Every bank contributes the rate at which it could borrow funds by asking for and afterwards accepting inter-bank offers in reasonable market size just prior to 11 AM. All Contributor Panel bank inputs are available on-screen to ensure transparency. Contributed rates are after that ranked in order and only the middle two quartiles (50% of contributed rates) are averaged arithmetically.

The resultant Contributor Panel membership is supposed to reflect the international composition of the London market and the significant trading in European currencies undertaken by banks based outside the euro-zone.