Fundamentals of Structured Product Engineering

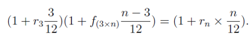

1. (a) Let rm denote the m month swap rate (or Libor rate). Subsequently the 3 × n month forward rate f(3×n) is calculated therefore

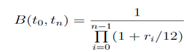

The discount curve is calculated therefore the n- month discount rate B(t0, tn) is

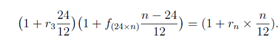

(b) The 24 × n month forward rate f(3×n) is calculated therefore:

(c) The components for this memo is a discount curve a 2-year forward curve a market for CMS swaps and Bermuda swaptions since the note is callable.

(d) Let cmsj,ki denote j-year CMS purchased for k years evaluated at the i-th year. Let ct0 be the premium for a 2-year Bermuda swaption.

Compute R1 = L0 +α0 where L0 is the current 1-year Libor rate and α0 is calculated as

ct0 = α0 + B(t0, t1)α0 + B(t0, t2)α0.

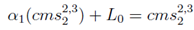

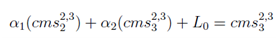

Year 2 coupon is: α1(cms2,32 )+L0+α0. We know cms2,32 and therefore α1 is calculated by equating:

giving α1 = 1- L0/cms2,32. Likewise α2 is calculated from

giving α2 = 1- cms2,32/cms2,33.

(e) The components for this memo is a discount curve a 3-year and a 2-year forward curve a market for CMS swaps and Bermuda swaptions (since the note is callable).

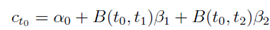

(f) Let's ct0 be the premium for a 2-year Bermuda swaption. Compute R1 = L0 +α0, where L0 is the current 1-year Libor rate and α0 is calculated as

At this point ct0,B(t0, t1),B(t0, t2) are known and the rest α0, β1, β2 has to be determined from that. α is computed as α = (cms3,30-cms2,30)/s30where s30is the 3-year swap rate.

(g) β1 = β2 can be chosen appropriately to satisfy ct0 = α0+B(t0, t1)β1 +B(t0, t2)β2.

2. (a) The note can be engineered therefore

• 1-year Libor deposit.

• Contract into a receiver interest rate swap paying Libor and getting 5.23%.

• Buy digital cap (for Libor > 6.13%) as well as digital floor (for Libor > 6.13%).

• Pay CMS10 for first 2 years as well as 8 × CMS10 for the next three years.

• Receive CMS30 for first 2 years as well as 8×CMS30 for the next three years.

(b) An investor who anticipate the yield curve to steepen in the long run and expects Libor to remain quite high would demand this product. He or She would expect Libor to increase and also the CMS spread to increase leading to an increase in the difference CMS30 -CMS10.