Fiscal Policy

An Increase in Government Spending:

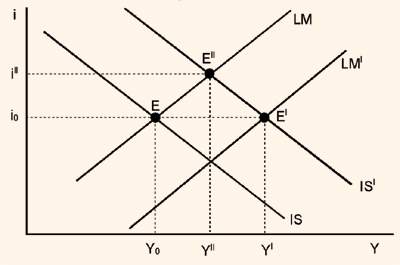

Figure 1

Let us examine how an increase in government spending affects the interest rate and the level of income. When government spending increases, at unchanged interest rates, the level of aggregate demand increases. To meet the increased demand for goods, output must rise as shown by a shift in the IS schedule in figure 1.

If the economy is initially at point E, an increase in government spending would shift the economy to point Ell if the interest rate remained constant. At Ell, the goods market is in equilibrium but the money market is no longer in equilibrium. Because of the increase in income, the quantity of money demanded goes up, which in turn pushes up the interest rate. With interest rate rising, firms planned investment spending declines and the aggregate demand begins to fall from the high level it reaches immediately on increase in the government spending. The economy finally reaches its new equilibrium at point E1where both the goods market and the money market are in equilibrium. As compared to point E, at point E1 the level of income is higher and so is the interest rate. Thus, an increase in government spending results in an increase in the level of income and an increase in the interest rate.

Crowding Out

See figure 1 again. Point Ell corresponds to the equilibrium when we neglect the impact of interest rates on the economy. In comparing Ell and E1, it becomes clear that the interest rates and their impact on aggregate demand dampen the expansionary affect of government spending.

Income, instead of increasing to the level of Yll, rises only to Y10 . This happens because the increase in interest rate from i0 to i1 reduces the level of investment spending. We say that the increase in government spending crowds out investment spending. Crowding out occurs when expansionary fiscal policy causes interest rates to rise, thereby reducing private spending, particularly investment.

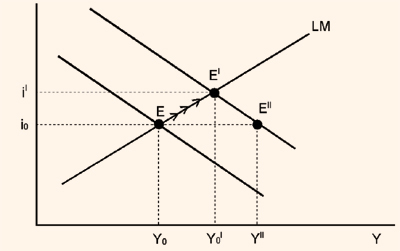

Is there a way to avoid crowding out of private investment as a result of expansionary fiscal policy? Yes, there is. The key is to prevent the interest rates from rising when government spending is increased. This can be done by an increase in the money supply. The monetary authorities can accommodate the fiscal expansion by an increase in the money supply. Monetary policy is accommodating when, in the course of a fiscal expansion, the money supply is increased in order to prevent the interest rates from increasing.

See figure 2. A fiscal expansion shifts the IS curve to ISl and moves the equilibrium of the economy from E to Ell. At Ell, though the income is higher than at E, the IS' interest rate is also higher than at E and rises from i0 to ill, thereby crowding out investment spending. But an increase in the money supply shifts the LM curve to LM' and the equilibrium of the economy to E1. The interest rate remains at i0, thereby avoiding crowding out of investment, and the level of output rises to Yl.

Figure 2