$7000 are invested at 5% per annum compound interest compounded yearly. What would be the amount after 20 years?

Solution

Here i = 0.05, P = 7000, and n = 20. Putting it in the formula we get:

FV = 7000 x (1+0.05)20

FV = 7000 x 2.6533 = $18573.1

We have taken a shortcut here. We looked at future value of 1$ at the end of 20 years at 5% interest in Future Value Interest Factor T able (which implies find the value of Future Value Interest Factor n, i) and found figure to be 2.6533 and then substituted the figure here to get answer.

Another way of doing it would be to use a scientific calculator and calculate value that comes out to be the same.

A 3rdway of doing this would be even simpler. Use a spreadsheet program. Let's see how we use Microsoft Excel to do the same.

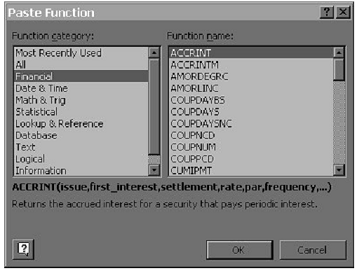

Step 1: Go to Insert menu and choose function. You get a screen which looks like this:

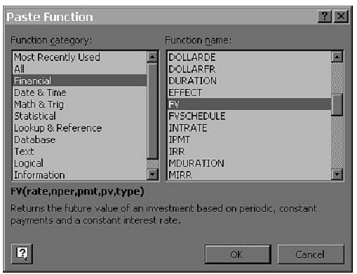

Step 2: In financial function category choose FV (it stands for Future Value) and press OK.

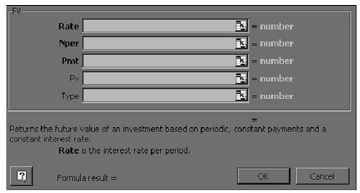

Step 3: You would get a screen that would look like this:

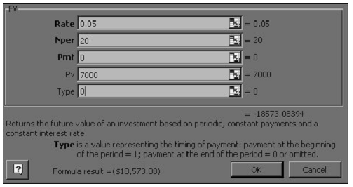

Step 4: Insert values as given in the illustration. Here r = I = 0.05, Nper is the number of periods = 20, Pmt is the periodic annuity (how to use it we will see later) = 0 in this case as there is no annual payment except first one. Pv is present value = 7000$ in this case and Type is a value representing timing of the payment = 0 in this case as investment is done at the end of period 0 or at the start of the period1. This also means that we get returns at the end of period 20 simultaneously when we make the last payment. Putting these values we get below screen.

Note that result of the figures which you input is shown in formula result section where it's 18,573.08 $.Compare this with figure that you get from using the value from table, a difference of 0.02 $. Negligible.

What if the money was payable at the start of period instead of at the end of the period? Here it doesn't matter as there is only one investment and that is also at the start of first period. It would matter when we look at future value of the annuity. Though what is an annuity anyway?