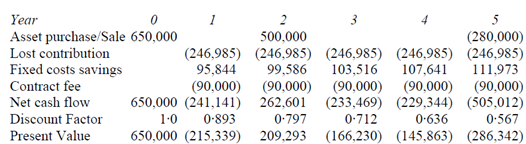

Q. Example on Differential cash flows?

Differential cash flows: contracting out versus in-house provision

NET PRESENT VALUE =£45519

The positive NPV signifies that the cash flows from contracting out exceed those from keeping the service in-house. Note the £3 difference among the NPV of the two alternative approaches is merely a result of rounding.

Contracting out the catering service is therefore the preferred alternative and it is recommended that Amber plc accept the tender from the outside supplier.

The financial effect is able to be assessed by comparison of the present value of the additional costs incurred with the present value of the incremental contribution.

WORKINGS

Present value of the further expense = 3·605 × £10000 = £36050

The further contribution amounts to 10% per year that is Years 1-5 Additional contribution = £24699 per year

Present value at 12% per year = 3·605 × £24699 = £89040

The net present value of the further investment in staff training is thus £89040 less £36000. This signifies that the net present value can be increased by £52990 by retaining the service in-house but increasing demand via improved services.

This further net present value is greater than the £45522 which is able to be created by switching to an outside provider for the catering service. The decision to contract out is consequently changed although Amber plc should be wary of the fact that the difference between the in-house and the contracted out service is only £7468 that is (£52990 - £45522). The advantage is so relatively insignificant. Perhaps more significantly the forecast that demand can be increased by as much as ten percent for the relatively small investment of £10000 per year (less than 2% of current variable costs) suggests that Amber plc must perhaps look more closely at the possible opportunities for increasing their contribution from the catering service before they choose to contract out. If demand is extremely sensitive to both price and quality it may perhaps require little investment to make the catering service very profitable.

The profits from investing internally however must be weighed against the potential gains to be earned from higher demand for a contracted out service. The additional information demonstrates that the company will receive 5% of gross sales receipts once daily sales exceed £2200. At present sales are at £2079 as well as so if the external contractor was able to raise demand by 10% Amber plc would receive 5% of the new annual revenue that is £41164 without incurring any additional expense. The choice so of whether to use the outside supplier or keep the service in-house is very dependent on the anticipated levels of future demand.