Example of Quantity Discounts

Consider illustration one and suppose that a quantity discount of 5 percent is given whether a minimum 200 units is ordered.

Required

Find out whether the discount should be in used and the quantity to be ordered.

Suggested Solution

We require considering the saving in purchase costs; savings in ordering costs and rise in holding costs.

Savings in purchase price:

New purchase price = 50 x 95% = Sh.47.50 per unit

Savings in purchase price per unit = 50 - 47.50

= Sh.2.50

Total units per year = 2,000

Total savings = 2,000 x 2.50

= Sh.5,000

Savings in Ordering Cost

Assuming an order quantity of 200 units per order, the total ordering cost will be:

= (2,000/100) * 50

= Sh.500

Ordering cost if 100 units is ordered

(2,000/100) * 100

= Sh.1, 000

Consequently savings in ordering costs = 1,000 - 500 = Sh.500

Increase in holding costs

Holding cost if 200 units are ordered

½(200)19.75 = Sh.1, 975

Holding costs if 100 units are ordered

½(100(20) = Sh.1, 000

Increase in holding costs = 1,975 - 1,000 = Sh.975

The Net Effect therefore:

Shs.

Savings in purchases costs 5,000

Savings in ordering costs 500

Total savings 5,500

Less increase in holding costs 975

Net savings 4,525

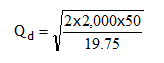

Cn = 15 + 10% x 4.75 = Shs.19.75

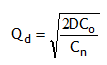

The discount should be taken because the net savings is positive. To determine the number of units to order we recomputed Q with discount Qd.

= 100.6 units

Decision rule:

Order the minimum discount quantity if Qd < minimum discount quantity.

Order Qd if Qd < minimum discount quantity.