Example of Miller-Orr Model

XYZ's management has put the minimum cash balance to be equivalent to Sh.10, 000. The standard deviation of daily cash flow is of Sh.2, 500 and the interest rate on marketable securities is 9 percent per annum. The transaction cost used for each sale or purchase of securities is of Sh.20.

Required

a) Evaluate the target cash balance

b) Evaluate the upper limit

c) Evaluate the average cash balance

d) Evaluate the spread

Solution

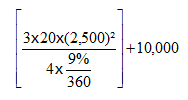

a) Z = [3B δ2 / 4i] 1/3 + L

= 7,211 + 10,000 = Sh.17,211

b) H = 3Z - 2L

= 3 x 17,211 - 2(10,000)

= Shs.31,633

c) Average cash balance = 4Z - L / 3

= (4 * 17,211 - 10,000) / 3

d) The spread = H - L

= 31,633 - 10,000

= Shs.21,633

Note: whether the cash balance increases to 31,633, the firm must invest of Shs.14,422 or 31,633 - 17,211 such in marketable securities and whether the balance decreases to of Shs.10,000, the firm must sell of Shs.7,211or 17,211 - 10,000 such of marketable securities.