Example of Baumol's Model

ABC Ltd. creates cash payments of Shs.10, 000 per week. The interest rate at marketable securities is 12 percent and every moment the company sells marketable securities, it incurs a cost as Shs.20.

Required

a) Find out the optimal amount of marketable securities to be transformed into cash every moment the company creates the move.

b) Find out the entire number of shifts from marketable securities to cash per year.

c) Find out the entire cost of sustaining the cash balance per year.

d) Find out the firm's average cash balance.

Solution

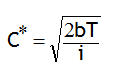

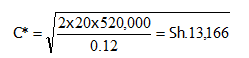

a)

Whereas: b = Shs.20

T = 52 x 20,000

= Shs.520, 000

i = 12 percent

Hence the optimal amount of marketable securities to be transformed to cash every moment a sale is made is Sh.13, 166.

b) Sum the no. of transfers = T / C*

= 520,000 / 13,166

= 39.5

≈ 40 times

c) TC = ½ (Ci) + T/c (b)

= (13,166* 0.12 / 2) + (520,000* 20 / 13,166)

= 790 + 790 = Shs.1, 580

Consequently the whole cost of keeping the above cash balance is of Sh.1, 580.

d) The firm's average cash balance is = ½C

= 13,166 / 2

= Shs.6,583