Evaluation of change in credit policy

Current average collection period = 30 + 10 = 40 days

Current accounts receivable = 6m × 40/ 365 = $657534

The Average collection period under new policy = (0.3 × 15) + (0.7 × 60) = 46.5 days

New level of credit sales = $6.3 million

Accounts receivable after policy change = 6.3 × 46.5/ 365 = $802603

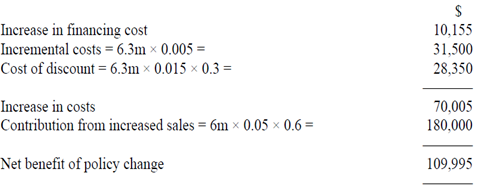

Increase in financing cost = (802603 - 657534) × 0.07 = $10155

The proposed policy change will raise the profitability of Ulnad Co

(b)

Determination of spread

Daily interest rate = 5.11/ 365 = 0.014% per day

Variance of cash flows = 1000 × 1000 = $1000000 per day

Transaction cost = $18 per transaction

Spread = 3 * ((0.75 * transaction cost * variance)/interest rate) 1/3 = 3 * ((0.75 * 18 * 1000000)/ 0.00014)1/3 = 3 * 4585.7 = $13757

Lower limit (set by Renpec Co) = $7500

Upper limit = 7500 + 13757 =$21257

Return point = 7500 + (13757/ 3) = $12086

The Miller-Orr model takes account of improbability in relation to receipts and payment. The cash balance of Renpec Co is permitted to differ between the lower and upper limits calculated by the model. If the lower limit is arrive at an amount of cash equal to the difference between the return point and the lower limit is raised by selling short-term investments. If the upper limit is arrive at an amount of cash equal to the difference between the upper limit and the return point is used to buy short-term investments. The model thus helps Renpec Co to decrease the risk of running out of cash while avoiding the loss of profit caused by having unnecessarily high cash balances.