Q. Evaluate Weighted average cost of capital?

As the investment is an extension of existing activities the risk of the investment will be estimated using the company's current equity beta. The cost of equity perhaps estimated using either CAPM or the dividend growth model. Utilizing CAPM

Ke = Rf + (Rm - Rf) beta, or 3·5% + (11% - 3·5%) 1·15 = 12·13%

Utilize the dividend growth model

Ke = D1/P+ g =36·4(1·04)/ 478+ 0·04 = 0·1192 or 11·92%

Both processes give a cost of equity of approximately 12%

The present pre tax cost of debt is 7·5% although this cost will vary as the proposed loan is at a floating rate. The weighted average cost of capital must be estimated using market values of equity and debt. The present market weighted gearing of Zendeck is

Equity 30 million shares at 478 cents = $143·4 million

Debt $34m + ($56m * 1·078) = $94·37 million

This is 60·3% equity 39·7% debt by market values.

WACC = Ke *E/(E+D) + Kd (1-t) *D(E+D)

Maintaining the current capital structure the approximate weighted average cost of capital is

12% (0·603) + 7·5% (1 - 0·3) (0·397) = 9·32%

(ii)

There is no simple method of adjusting the CAPM cost of equity for issue costs instead cash flows would be adjusted when undertaking the investment appraisal.

Utilizing the dividend growth model the revised equation including issue costs is

Ke =D1/(P - I) + g where I is issue costs

Ke =(36·4 (1·04))/ 478 - 31+ 0·04 = 0·851 + 0·04 = 0·125 or 12·5%

(31 is issue costs = 478 × 0.065

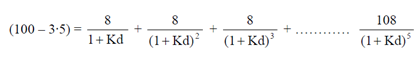

Assuming the new debentures carry the similar risk as the existing ones and that there are three years until the redemption of the existing debentures the current gross redemption yield (cost) of debentures may be estimated from

$107·8m =11/(1+ Kd)+11((1 +Kd)2) )+11((1 +Kd)3) )+100((1 +Kd)3)

By trial and error

At 9%

11 * 2·531 = 27·84

100 * 0·772 = 77·20

------

105·04

At 8%

11 * 2·577 = 28·35

100 * 0·794 = 79·40

------

107·75

The gross deliverance yield of existing debentures is approximately 8%.

Assuming the new debentures have a alike risk to existing debentures they will be issued at par of $100 with a coupon of 8%. They are as well assumed to be issued for the expected maturity of the investment, five years. The efficient cost of the debentures may be estimated by solving

At 9%

8 × 3·890 = 31·12

100 × 0·065 = 65·00

------

96·12

At 8% the value is $100 by definition

Interpolating: 8% +3·5/(3·5 0·38) * 1% = 8·90%

The weighted average cost of capital is

12·5% (0·603) + 8·90 (1 - 0·3) (0·397) = 10%

The issue costs as well as use of a different type of debt increase the WACC by about 0·70%.