Direct Material Price Variances

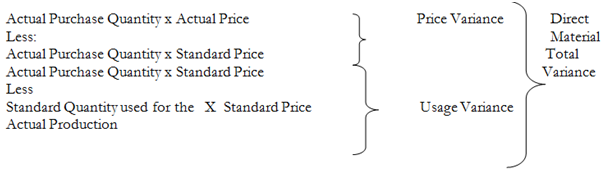

The two direct material price variances can be summarized given as:

From our basic data first before the beginning of the discussion on variances, then we can calculate as given:

i.) Direct Materials price variance= (AQ X AP) - (AQ X SP)

= (6,500 X 3.80) - (6,500 X 4)

= 6,500 (3.80 - 4)

= Kshs.1,300 Favourable

The variance is favourable since we utilized less costs than the standard cost.

ii) Direct Materials usage variance = (AQ X AP) - (SQ X SP)

= (6,500 X 3.80) - (6,000 X 4)

= 24,700 - 24,000

= 700 Unfavourable

Note that the above equation total materials variance agrees along with the specified as:

Total Materials Variance = Price Variance + Usage (Efficiency) Variance

= 1300 (Favourable) + 2000 (Unfavourable)

= Kshs.700 unfavourable.

Tutorial Note Please makes sure you follow the basics of the calculation of the direct material variances calculations hence you can effectively follow the given variances sections.