(a) The value of a share of Rio National Equity on 31 December 2002, using the Gordon growth model and the capital asset pricing model, can be determined as follows.

Required rate of return using CAPM,

k = rf + β (kM - rf) = 4% + 1.8*(9% - 4%) = 13%

The value of share using Gordon growth model,

P0 = D0*(1 + g)/(k -g) = $0.20*(1 + 12%)/(13% - 12%) = $22.40

Thus the value of a share of Rio National equity has been determined to be $22.40.

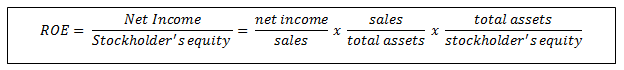

(b) The three components of Rio National's return on equity (ROE) for the year 2002 using the DuPont model are as calculated as follows

Net profit margin = Net income/ sales = $30.16/$300.80 = 10.03%

Total Assets Turnover = Sales/Total assets = $300.80/$541.40 = 0.556

Equity multiplier = Total assets/Stockholder's equity = $541.40/$270.35 = 2

Thus the three components of Rio National's ROE have been calculated as 10.03%, 0.556 and 2.

(c) The sustainable growth rate of Rio National on 31 December 2002 can be determined as follows

Growth rate, g = Earnings retention rate*ROE (or) (1 - Dividend payout ratio)*ROE

Dividend payout ratio = Dividends paid/Net income = $3.20/$30.16 = 10.61%

ROE = Net income/Stockholder's equity = $30.16/$270.35 = 11.16%

g = (1 - 10.61%)*11.16% = 9.97%

Thus sustainable growth rate has been calculated to be 9.97%