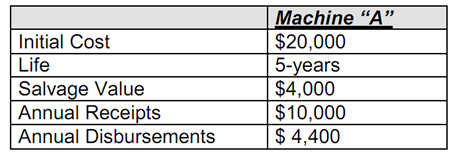

A contractor established a policy to purchase equipment over leasing only if the return is a minimum of 15%. Given the following conditions, the contractor's decision based on the policy reveals that:

a. The equipment purchase yields a minimum 15% return

b. The equipment purchase yields less than a minimum 15% return

c. The purchase yields a neutral or $0 return

d. Cannot be determined without additional information

Solution:

The contractor's goal is to accept a purchase with Internal Rate of Return (IRR) larger than the discount rate in which he can borrow money. The first step is to identify the rate of return on the investment. An example would be to use a geometrically rising series of values.

A typical means of computing IRR is to identify the discount rate that sets the Net Present Value (NPV) to $ 0 (zero dollars).

Applying the concept yields an Internal Rate of Return (IRR) that must satisfy the Contractor's goal.

Find the NPV using a 15% IRR by establishing a zero sum equation

$0 = - $20,000 + $5,600 (P/A, IRR%, 5) + $4,000 (P/F, IRR%, 5)

$0 = +$760

Therefore, $0 IRR = $760 which is > 15% IRR; the purchase is justified.