Q. Determine Annual effective cost?

(i) Payables policy

One month cost of taking extended trade credit = 1.5/98.5 = 1.52%

Annual effective cost = 1.015212-1 = 19.8%

Overdraft is cheaper finance at 15% per annum.

Thus the company must not take extended credit that is the discount should be accepted.

(ii) Inventory valuation without early discounting

Inventory evaluation: production = 800 cars.

EOQ ignoring volume discounts = √[(2 × delivery costs * annual demand)/(holding costs per unit)] = √[(2 × 1200 * 800)/(22% * 1300)] = 81·93 or 82 whole units.

At this stage a quantity discount would apply. Re-working the preceding calculation with the quantity discount gives = √[(2 × 1,200 × 800)/(22% × 1,300 × 98%)] = 82·76 or 83 whole units.

Therefore the choice facing Frantic Ltd is between ordering 83 units or 250.

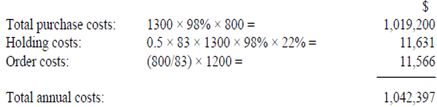

Unit valuation for an order quantity of 83:

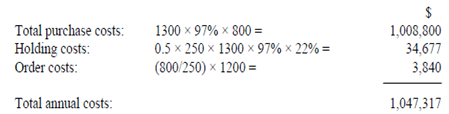

Unit valuation for an order quantity of 250:

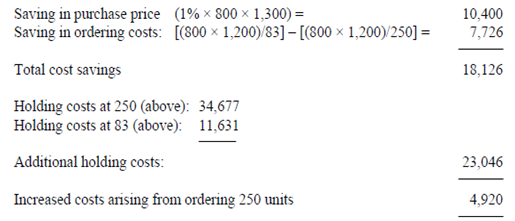

An alternative respond relies on the basic EOQ calculation adjusted for the appropriate discount resulting in 83 units per order and then compares this with an ordering policy of 250 in the following incremental cost manner

Therefore the same conclusion is reached.

The optimal policy is thus to order 83 engines at a time.

(iii) Receivables

One month cost of offer the discount = 2/98 = 2.04%

Annual effective cost of offering discount = 1.020412-1 = 27.4%

This is more than the 15% cost of bank overdraft that is offering the discount is relatively expensive.

Therefore the discount must not be offered.