Demand for Risky Assets

* Assets

- Something which provides a flow of money or services to its owner.

- The flow of money or services can be explicit or implicit .

* Capital Gain

- An increase in value of an asset, while the decrease is a capital loss.

* Risky & Riskless Assets

- Risky Asset

- Provides uncertain flow of money or services to the owner.

- Examples

- Apartment rent, corporate bonds, capital gains, stock prices

- Riskless Asset

- Provides flow of money or services which is known with certainty.

- Examples

- Short term government bonds, short term certificates of deposit

* Asset Returns

- Return on an Asset

- The total monetary flow of asset as fraction of its price.

- Real Return of an Asset

- The simple return less the rate of inflation.

* Asset Returns

Expected versus Actual Returns

- Expected Return

- Return which an asset should earn on average

- Actual Return

- Return which an asset earns

- Higher returns are associated with the greater risk.

- The risk averse investor should balance risk relative to return

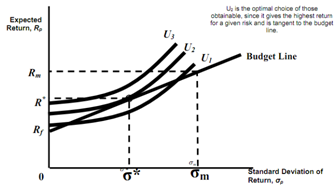

* Risk and Budget Line

Expected return, RP, increases as the risk increases.

The slope is price of risk or risk-return trade-off.

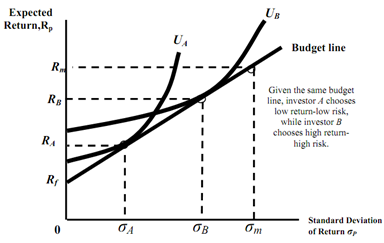

Choosing Between Risk and Return

The Choices of Two Different Investors