Demand for Health Care in the Presence of Health Insurance

The understanding of the demand for health insurance is useful to explain why some people insure against certain types of medical loss while others do not. This means that all persons are not risk averters (i.e. some people are risk takers). It is important to understand the type of the health care costs which creates demand for health insurance. Cost of hospitalisation and surgery are far more likely to qualify as cases of high expected losses although possibly with relatively low probability of occurrence. Costs of medical cares such as physician visits at home or office, optometric service, drug and dental care, etc. are relatively smaller and therefore considered manageable without insurance coverage. The mode of the demand for health insurance suggests that the adequacy of health insurance coverage should be examined separately for each type of medical service. Thus, even if one were a risk averter, we would not expect him to buy health insurance for all of his medical needs. The price of insurance should not be so high as to make people worse off with its cost exceeding the benefits.

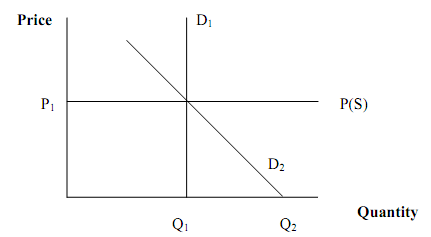

The presence of health insurance might lead to indulgence in moral hazard in the health care demand behaviour of a person. In the presence of health insurance, moral hazard leads to higher demand for health care than that is really required.This can be illustrated with the help of a diagram (graph). If the demand is inelastic (e.g. an insulin dependent person who has to take the insulin no matter the cost),his demand will be D1 for Q1 amount of insulin. In the case of moral hazard, the quantity of medical care that would be demanded would depend in part on the price for that care. If insurance covers the entire cost of the illness, then the individual represented by the demand curve D2 would demand Q2 units of medical care. The presence of some elasticity in the demand curve indicates that the individual will demand different quantities of medical care depending upon how much must be paid for that care. Since the insurance lowers the price of medicalcare more medical care would be consumed than when there is no insurance.

Demand for Health Care Insurance Against Price: Points of Trade-off

A question that arises in this context is whether this increase in the demand for health care, when insurance coverage is available, is irrational on the part of a consumer. The answer is 'no' as it is perfectly normal for a consumer to maximise the benefit of his insurance coverage. In other words, the individual equates the marginal cost of purchasing the health care with the marginal benefit of buying the additional units. However, insurance coverage that reduces the price to zero reflects an inefficient use of medical resources. An implication of the existence of moral hazard is also that although individuals with insurance tend to consume higher units of medical care, they may still be unwilling to purchase an insurance policy that provides such extensive coverage. Instead of paying the high premium that usually goes with such extensive coverage, an individual may well prefer to self insure or to purchase a less comprehensive insurance policy.

With different types of the health insurance schemes and the elasticity of demand for health care, the impact of moral hazard needs to be assessed. Irrespective of whether moral hazard exists or not, and even if all individuals were risk averse, insurance coverage for 100 per cent of their medical expenses would not be preferred by all persons given the additional transaction costs associated with it.With people having different demand for medical care, no single insurance policy would be best for everyone. While some persons would prefer to have only some types of medical expenses covered, in the presence of moral hazard, insurance companies would prefer to have carefully designed cost sharing features.