On-line fair and ethical share trading system (Olfest)

A system is required that allows on-line customers to buy and sell stock market shares in a selection of companies.

Background

The Olfest system allows people to trade in stock market shares on-line whilst ensuring that the companies whose shares they are buying are not involved in any unethical practices, such as using child labour or polluting the environment. It is to be used by people with money to invest who want to be sure that their money is not being used in an unethical way.

Each stock market company that is being considered for inclusion in the scheme is thoroughly research by the Olfest team to ensure that they are ethical in their business practices. Only then are the shares for the company made available on-line. Members of the scheme pay a small fee when they join which provides the resources for this vetting process.

The users of the system

Enquirers

People visiting the site who are interested in the scheme but are not members can request to have a pack of information sent to them.

Members

These are people who have joined the scheme by paying a small fee and have been given a user name and password for the system. They can browse through the companies whose shares are available and they can buy and sell shares.

Administrators

Must be able to add details of new members and companies whose shares are traded. They change the price of shares on a daily basis and sometimes more often in the markets are volatile. They can remove members and companies or change their details. They will also want to produce daily, weekly and monthly reports on shares that have been bought and sold.

Summary of Requirements

1. Administrators must be able to record details of companies and their shares

1.1. To record name and addresses for each company

1.2. To record the share price for the company

2. Administrators must be able to control scheme membership

2.1. To record name, address, contact phone number, credit card details and email address of members and prospective members

2.2. To vet a prospective member for credit worthiness

2.3. To allocate a username and password to a member

2.4. To remove a member from the scheme

3. Scheme members must be able to trade in shares

3.1. To browse through companies and see their share price

3.2. To see what shares they currently have and their current stock market price

3.3. To sell shares that they own

3.4. To buy shares

4. Administrators must be able to find out what trading has taken place

4.1. To print a report of details of all trading in shares over the last day, week or month

4.2. To view a total of shares bought and sold in any day, week or month

5. Prospective members must be able to make enquiries

5.1. To browse through companies and see their share price

5.2. To request membership through an on-line form

6. Non-functional requirements

6.1. To restrict access to buying and selling shares to scheme members using a password system

6.2. To restrict updating of company and share data to administrators using a password system

6.3. To prevent members credit card details being available to anyone else

The Document that you must produce for the coursework

1. Use Case Diagram

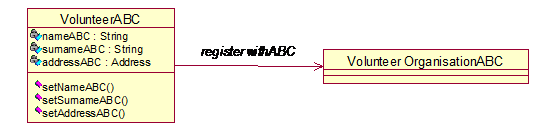

Important note: the label that you give each use case and class must end with the first three letters of your given coursework group name e.g. If your group name is ABCDE each use case and class name will end in ABC. You must use this labelling scheme throughout your solutions. Any names that you give for attributes, operations or associations must also end with the first three letters of your given coursework group name.

2. Sequence Diagrams

You will be given a sequence diagram and set of questions to answer.