The Critical Thinking about CVP is described below

CVP is more than just a mathematical tool/device to calculate values such as the break-even point. It can be used for the critical evaluations about the business viability.

For instance, a manager should be conscious of the "margin of safety." The margin of protection is the degree to which the sales go beyond the break-even point. For Leyland, degree to which sales exceed is approximately

$2,000,000 (its break-even point) is the margin of the safety. This will give a manager some valuable information as they plan for predictable business cycles.

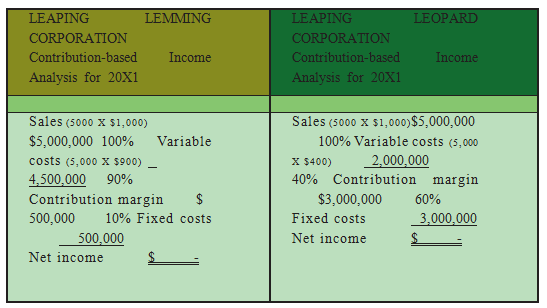

A manager should also recognize the scalability of the business. This refers to the ability to improve profits with rise in volume. Evaluate the income analysis for the Leaping Lemming Corporation and the Leaping Leopard Corporation:

Both the companies "broke even" in 20X1. Which company would you to a certain extent own? If you knew that each company was growing quickly and expected to double sales each coming year

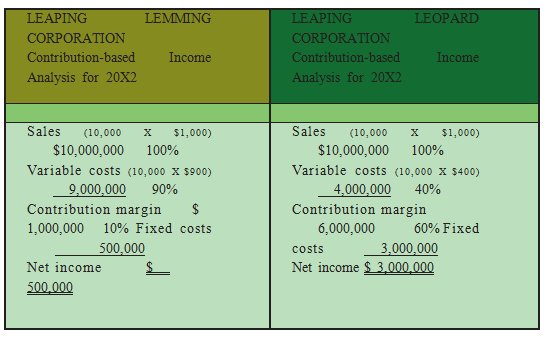

(without any alteration in the structure of their cost), which company would you prefer? With the added information, you would expect the below obtained outcomes for 20X2:

This study reveals that the Leopard has a much more scalable business model. Its contribution margin is very high and once it clears the fixed cost hurdle, it will turn out to be very profitable. Lemming is fighting a never finishing battle; sales increases are met with considerable increases in the variable costs. Be conscious that the scalability can be a double-edged sword. Pull backs in volume can be shocking to companies like Leopard because the fixed cost load can be consuming. Whichever the condition, managers are required to be fully cognizant of the effects of the changes in scale on the bottom-line performance.