(i) In terms of cashflow, which month will be the most costly for your project?

(ii) If the 3rd and 4th months are more expensive by 25% each because the outsourced labour took longer than expected, what is the effect on the final predicted project cost? What action do you think you could take in these circumstances?

3(c) Assume you have completed three months of the project. The Budget at Completion (BAC) was $250,000 for this six-month project. Also assume the following:

Planned Value (PV) = $150,000

Earned Value (EV) = $140,000

Actual Cost (AC) = $125,000

Use this information to answer the following questions.

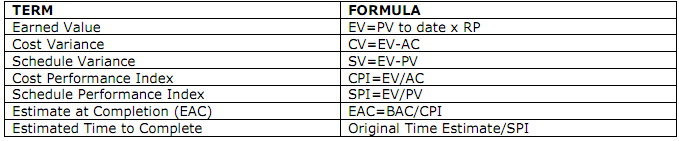

(i) What is the cost variance, schedule variance, cost performance index (CPI), and schedule performance index (SPI) for the project?

(ii) Use the CPI to calculate the estimate at completion (EAC) for this project. Use the SPI to estimate how long it will take to finish this project. Sketch an earned value chart using the above information, including the EAC point. Use the chart below (Figure 7-5, p.289 in Schwalbe 5ed) as an example of what your Earned Value Chart should look like. Comment on your chart.

(iii) How is the project doing? Is it ahead of schedule or behind schedule? Is it under budget or over budget? Should you alert POSS senior management and ask for assistance?