Cost of capital calculation

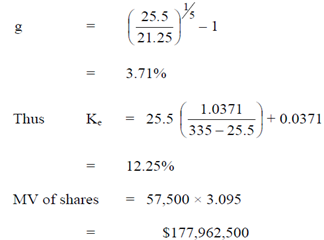

Cost of equity (Ke)

Using the dividend valuation model, Ke=D1/P0+ g

Pretentious that dividend growth over the last five years is a good indicator of shareholders' expectations regarding the future.

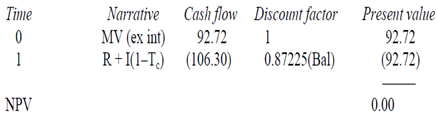

Cost of debt (Kd)

The Kd will equivalent the IRR of the cash flows from the company's perspective.

The debt will be redeemed in one year consequently it is possible to calculate the cost exactly.

Consider a bond with normal value $100.

The t = 1 discount figure is 1/(1 Kd)

Which must equal 0.87225 to give a NPV of zero

Thus 1 + Kd =1/0 87225= 1.1465, giving Kd = 14.65%

The MV of the debt = $100 million × 92.72% = $92,720,000 ex interest.

WACC

The WACC usually includes long-term finance only. In the condition of Fizzers plc the debt is to be redeemed in one year's time. Therefore the debt should only be included in the WACC if it is assumed that more debt will rise in the near future to replace it. (If not after that the WACC is the cost of equity of 12.25%).

WACC =(12.25 × 177.96 + 14.65 × 92.72)/ 270.68= 13.07% ≈ 13%

The suppositions made above are justifiable for the following reasons.

- Past dividend growth has been reasonably steady consequently it is likely that shareholders will expect similar in the future. It is their prospect that determines the share price. Growth of 2% in 20X8 and 20X9 might be a improved estimate for future growth than the five year average.

- The Company's existing gearing ratio debt: equity is around 1:2 which look like reasonable. Both speculation of gearing suggest that with the presence of corporation tax some gearing is advised so it is likely that the directors will seek to raise more debt in the future. Whether they will aim for accurately the same gearing ratio and use debt with the same cost is less certain.

(b) Suitability

The WACC has been computed to use as a discount rate for appraising the new overseas venture. To utilize the existing WACC relies on the following assumptions.

- Gearing is set aside constant.

- The project has the similar business risk as the company's existing activities.

- The project isn't big.

The figure computed is not suitable for the following reasons.

- It is implicit that the project will financed out of retained cash reserves. This will not protect the current gearing of the company.

- The overseas venture engrosses a different market with different systematic risk to the bulk of existing activities.

- The project is a main undertaking.