Using the information provided prepare the four financial statements for inclusion in Plantagenet Ltd's Annual Report dated at its balance date of 30th June 2011. The statements should be prepared according to the requirements of the relevant accounting standards and the requirements of the Corporations Act. Relevant notes (including Note 1) to the accounts must be included.

Comparative data is not required.

Note: A number of calculations will result in decimal places being shown. Other than for Earnings per Share, do not show cents - round your calculations to the nearest dollar.

An appendix is to be included showing any additional calculations not set out in the notes to the statements.

Plantagenet Ltd's Trial Balance as at the 30th June 2010 was:

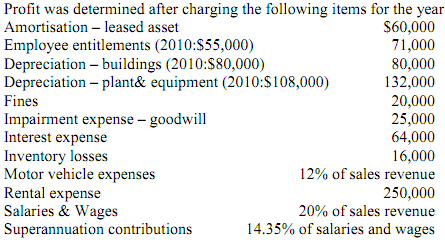

(f) The following balance day adjustments will need to be allowed for:

- Closing inventory is to equal 15% of Cost of Goods Sold,

- Closing balance of Accounts Payable to equal 70% of Inventory,

- Closing balance of Accounts Receivable will be equal to 1.5% of Sales Revenue,

- The Doubtful Debts provision will be equal to 12.5% of Accounts Receivable at the end of the year.

(g) During the current year Plantagenet Ltd paid $92,000 to its auditors, of which $39,000 related to services other than the annual audit and half yearly review.

(h) Prior to the end of the current year Plantagenet Ltd confirmed they will be declaring a final dividend equal to 12.5% of the company's net profit after tax.

(i) On 1 April, 2008 the company was required to lodge a deposit of $150,000, which earned interest at the rate of at 8%, as security for their Short Term Loan.

(j) Plantagenet Ltd purchases 90% of its raw materials from one supplier, Cowra Ltd. The directors are currently investigating alternative sources of raw material.

(k) The mortgage loan is secured by a first mortgage over freehold land and buildings. There are three annual instalments remaining.