Q: How family life cycle as well as family decision making can influence consumer behaviour?

Ans: Families and Family Decision Making

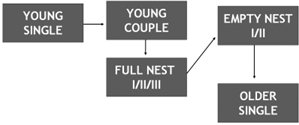

The Family Life Cycle- Individuals as well as families tend to go through a "life cycle:" The simple life cycle goes from

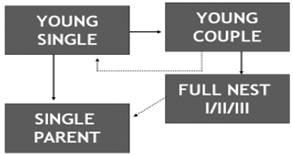

For ideas of this discussion a 'couple' may either be married or merely involve living together. The divide of a non-marital relationship involving cohabitation is similarly considered equivalent to a divorce. In real life this circumstances is of course a bit more complicated. For instance many couples undergo divorce. Subsequently we have one of the scenarios:

Single parenthood is able to result either from divorce or from the death of one parent. Divorce typically entails a significant change in the relative wealth of spouses. In some circumstances the non-custodial parent (usually the father) will not pay the required child support and even if he or she does that still mayn't leave the custodial parent and children as well off as they were during the marriage. Alternatively in some cases some non-custodial parents will be called on to pay a large part of their income in child support. This is mainly a problem when the non-custodial parent remarries and has additional children in the second (or subsequent marriages). In any event divorce habitually results in a large demand for:

>>Low cost furniture as well as household items

>>Time-saving goods as well as services Divorced parents frequently remarry or become involved in other non-marital relationships therefore we may see

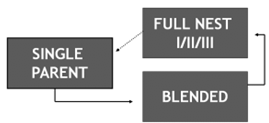

Another variation involves

Here the single parent who presumes responsibility for one or more children may not form a relationship with the other parent of the child.

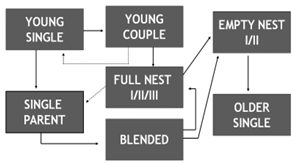

Integrating every possibilities discussed us get the following depiction of the Family Life Cycle:

Usually there are two main themes in the Family Life Cycle subject to significant exceptions

- As a person gets older he or else she tends to advance in his or her career and tends to get greater income (exceptions- divorce, maternity leave and retirement).

Unfortunately obligations as well tend to increase with time (at least until one's mortgage has been paid off). Children as well as paying for one's house are two of the greatest expenses.

Note that even though a single person may have a lower income than a married couple the single may be able to buy more discretionary items.