Basics of Callable Bonds

A callable bond is a convertible bond with the favorable feature of call option available to the issuer. When the firm feels that its stock is undervalued in such a way that selling stock directly would dilute the equity of current stockholders and if the firm does not prefer the route of debentures/debt, then it issues a convertible bond duly setting the conversion ratio on the basis of a stock price acceptable to the firm. Once the market price reaches the conversion point, the firm will want to see the conversion happen in view of the risk that the price may drop in the future.

The holder of a callable bond thus gives the issuer the right to call the issue prior to the expiration date. In fact, the bondholder is put to two disadvantages. First, the bondholders are exposed to the reinvestment risk, since an issuer will call the bond when the yield on bonds in the market is lower than the issue's coupon rate. Let us try to understand this concept with the help of an example. Suppose a firm has issued a callable bond with a coupon rate of 13%. Subsequently, the market rates come down to 7%. When funds are available at 7% in the market, why should the firm pay interest at 13% to the bondholders? Since it has the option to call, it utilizes the opportunity, pays cash to the bondholder and goes for the 7% issue.

The second disadvantage is that the price appreciation potential for the callable bond in a declining interest rate regime is limited. This happens because the investors can reasonably expect that the firm would prefer off-loading the bonds by redeeming at the call price since the market rates of interest have fallen. This phenomenon of a callable bond is called price compression.

In view of the two disadvantages associated with callable bonds and in order to make them attractive, the issuer often provides a call protection for an initial period, akin to the lock-in-period during which the bond may not be called. Despite this, why would any investor prefer this at all with inherent reinvestment risk and price compression unless otherwise sufficient potential compensation in the form of a higher potential yield is explicitly provided?

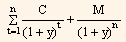

The yield associated with a callable bond is simply the interest rate at which all the coupon payments (generally semi-annual) and the call price are discounted to equate with the price of the bond. Put differently,

P =

Where,

M = call price in rupees,

n = number of periods until the first call date.

The discount rate 'y' in this equation represents the yield to call and 'C' is coupon.

The yield to call assumes that (1) the investor will hold the bond to the assumed call date, and (2) the issuer will call the bond on the date. However, these assumptions are unrealistic in the sense that they do not take into account the rate at which the investor can reinvest the proceeds after the issue is called. For example, for a five-year bond, the investor intends to hold the bond for five years, but when the bond is called at the end of the third year, the total return for five years will depend upon the interest at which the proceeds are reinvested from the call date to the end of the fifth year. Thus, it is not possible to calculate the yield to maturity for such callable bonds.