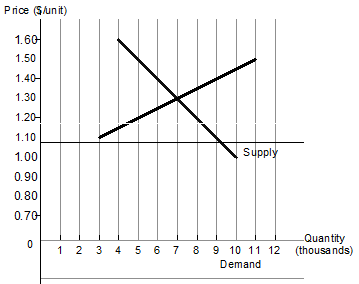

Question 1: What is the equilibrium price and quantity?

Question 2: How do you describe the market situation, if the market price is higher than the equilibrium price?

Question 3:The government imposes a price ceiling of $1.20/unit. Calculate the surplus (shortage).

Question 4: The government imposes a price floor of $1.50/unit. Calculate the surplus (shortage).

Question 5: If the government imposes a quota of 5000units, calculate the supply price, the demand price, the quota rent, and the deadweight loss to the society.

Question 6: The government decides to tax the good X at a rate of $0.30/unit and collect that tax from the consumers, calculate the price paid by the consumers, the price received by the producers, the tax revenue, and the deadweight loss to the society. Calculate the incidence of tax. By using the elasticity of demand and supply comparison, explain why consumers (producers) are paying more tax than the producers (consumers).

Question 7:The government decides to tax the good X at a rate of $0.30/unit and collect that tax from the producers, calculate the price paid by the consumers, the price received by the producers, the tax revenue, and the deadweight loss to the society. Calculate the incidence of tax. By using the elasticity of demand and supply comparison, explain why consumers (producers) are paying more tax than the producers (consumers).