A. Mitt starts Examine Your Zipper Incorporated ("XYZ") in 2012 by selling common stock of $12,000,000. He promises the investors in his company a 15% return on their capital.

B. On December 31, 2012, Mitt takes this money and buys $1,000,000 worth of land, $5,000,000 of equipment, $5,000,000 of licenses, and put the remaining $1,000,000 into an operating checking account to fund day-to-day operations. Consequentially, the Free Cash Flow ("FCF") for 2012 is a negative $12,000,000 (-$12,000,000).

C. XYZ has a contract to provide 1,000,000 of their product a year to a distributor. They never sell more or less than 1,000,000 units. So in 2013, XYZ produces and sells 1,000,000 units.

D. The contract runs for 99 years (assume it goes forever).

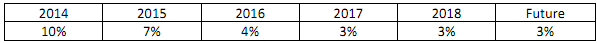

E. The contract specifies the price the distributor will pay each year. In 2013, the price per unit is $6.50. After 2013, the price escalates as follows:

So in 2018, the price should be $8.44/unit if you've done this correctly.

F. XYZ pays 25% of its total revenues in inventory costs and 50% of its total revenues in labor costs every year. If done correctly, this should result in Cost of Goods Sold (COGS) of $4,875,000 in 2013.

G. XYZ depreciates its equipment over 10 years with no salvage value. XYZ amortizes its licenses over 20 years.

H. XYZ's tax rate is 40%.

I. XYZ needs to always have some inventory on hand to keep production constant. As a result, XYZ has a practice in December of each year of buying one month of inventory to have on hand for January. So, in other words, each December XYZ purchases 1/12th of its current year inventory purchase in December to hold it over to the next year. If you've done this correctly, your balance sheet should show $135,416.67 of inventory in 2013 and $148,958.33 of inventory in 2014.

J. XYZ purchases half of this extra inventory on credit. Thus, XYZ always carries an Accounts Payable at the end of every year in the amount of half of the inventory purchase. If you've done this correctly, your balance sheet should show $67,708.33 in 2013 and $74,479.17 in 2014.

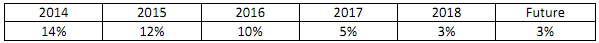

K. Starting in 2014, XYZ is forced to add additional equipment and licenses to its operations to keep up with growth. They add the following amounts each year:

So, in 2014 the total equipment should be $5.7M and the total licenses should be $5.7M. The depreciation expense for each year should continue to be the total equipment divided by ten.

The amortization expense for each year should continue to be the total licenses divided by twenty. If you've done this correctly, your depreciation expense should be $500,000 in 2013 and $570,000 in 2014 and your amortization expense should be $250,000 in 2013 and $285,000 in 2014.

L. Mitt wants to hold on to $1,000,000 at the end of every year to have some cash to cover operations and distribute the rest to his shareholders as a dividend. This means $1,207,291.67 of dividends in 2013 if done correctly.

QUESTIONS:

1. What is the value of the XYZ's operations? Calculate the company's horizon value in 2018.

2. Assume that a bank would be willing to lend Mitt as much money as he wants on the following terms: 30 year amortization, 2% annual interest. How much money would Mitt have to borrow to get his investors the 15% return that they require? (If he is borrowing the money, he would do this instead of issuing stock. He still needs to raise $12M, he just would do part of it with debt.