It is also important to compare the returns from the equity stock and the bond to determine the profitability of both investments. We have seen above that the dividend paid on equity is Rs.0.75. That is, a current yield of 0.75/11 = 0.06818 or 6.82%. The bond, at 10%, will yield 10/117 = 0.08547 or 8.55%.

We note that holding the bond gives us a better return than the outright purchase of the common stock. Under these conditions, we try to calculate the number of years required to recover the conversion premium, which results due to different cash flows from the instruments. This period is referred to as the Break Even Period. It is calculated by the formula given below.

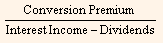

Break Even Period =

Substituting this with values from our example, we have,

Break Even Period =  = 2.8 years.

= 2.8 years.

Till now we have been looking at a well-known model called the "Traditional Valuation Model". In a more systematic manner,

Annual cash flow differential = Face amount x Coupon rate - Conversion value x Dividend yield,

and the payback period is,

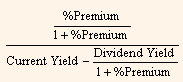

Payback period =

We should notice that this method is only an adaptation of the method used in capital budgeting and has its own drawbacks.