Balanced Score Card or BSC

We see in which the traditional model does not reflect the significance of intangible assets, their capturing and measuring mechanism and does not reflect the future prospects of the business. It is a collision among the long term capabilities & competitive edge at one end and the historical-cost that is immovable i.e. movable and immovable. The balanced score card involves measures of the drivers of future performance along with the financial measures of past performance. It addresses the core issue of creation of future value by investment in technology, processes, innovation (for information age competition), employees, customers and share holders.

Kaplan and Norton, who are considered the father of Balanced Score Card, developed that card that addresses the entire requirement. They define the innovation of this card as follows:

"The balanced scorecard retains traditional financial measures. Other than financial measures tell the story of past events, an adequate story for industrial age organization for those investments in long-term capabilities and customer relationships were not critical for success. Those financial measures are inadequate, therefore, for guiding and evaluating the journey in which information age companies must make to create future value by investment in customers, employees, suppliers, processes, innovation, and technology."

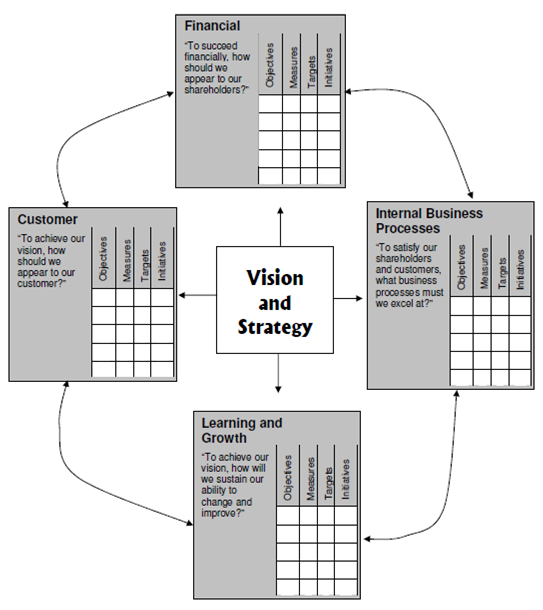

The balanced scorecard suggests in which we view the organization from four perspectives, and collect data, to expand metrics, and analyze it associative to each of these perspectives. The pictorial representation of this model is display below:

Figure: Four Perspectives of an Organization