Aggregate demand in the cross model

Because C and Im depends positively on Y while G, I and X are exogenous, aggregate demand YD will depend positively on Y:

YD(Y) = C(Y) + I + G + X - Im(Y)

When Y increases, C and Im increases though since C increases more than Im, aggregate demand would increase when Y increases.

You may react to the notation YD(Y). Though if you think of Y as the national income (GDP = national income) then YD(Y) basically tells us that aggregate demand depends on income. Aggregate demand is the total quantity of finished services and goods that all sectors (government, consumers, firms and rest of the world) together wish to buy under different conditions. Notation YD(Y) tells us that only endogenous variable which affects aggregate demand is national income. The higher the income, the more we wish to buy. YD, C, Im, S, SH, SG, SR and NT all rely on Y whereas I, G and X are exogenous. We can explain this using the following diagrams.

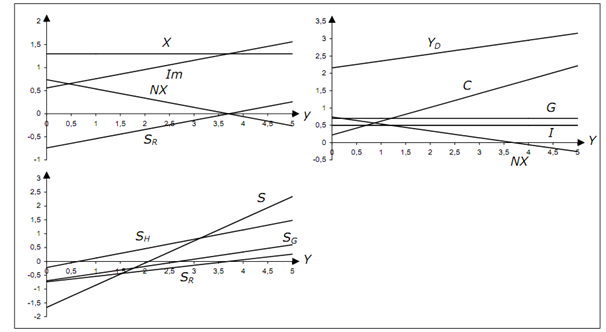

Figure: Aggregate demand and its components

Every diagram has real GDP on the x-axis.

- First diagram demonstrates exports (X), imports (Im), net exports (NX) and rest of the world savings (SR). In this figure, X = 1.3 and Im = 0.56 + 0.2Y.

- Second diagram illustrates private consumption (C), investment (I), government spending (G), net exports (NX) and aggregate demand (YD = C + I + G + NX). Here, C = 0.22 + 0.4Y, I = 0.5, G = 0.7.

- Third diagram shows private savings (SH), public savings (SG), rest of the world savings (SR) and total savings (S = SH + SG + SR). They are created from NT = 0.26Y.

This figure précises all variables in the cross model and how they rely on Y. Essentially these dependences will be the same in all of the Keynesian models.