Accounting Case Study:

The Champlain Career Consulting Corporation ("CCCC") is owned by three Trent graduates. Incorporated in 2009, CCCC provides a wide-range of career planning and counseling services. Their clients include both individuals and companies operating in the Peterborough area. Trent University is one of their largest clients.

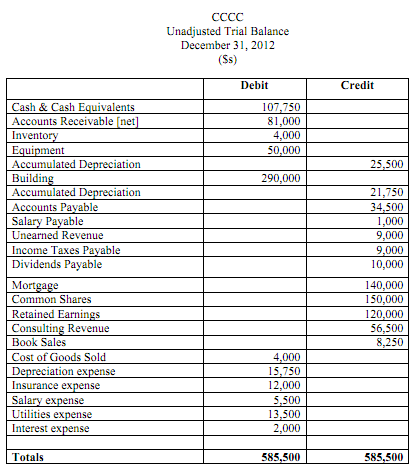

In a cost-cutting move in 2012 CCCC outsourced its accounting department to an independent bookkeeping company. It is now year-end (December 31, 2012) and the bookkeeping company isn't available due to a recent merger with another firm. Charlie (one of the owners of CCCC) prepared the unadjusted Trial Balance at December 31st. However, he found an envelope in the drawer of the desk used by the bookkeeping company that contained several notes about financial transactions and he is not sure what to do with the information.

CCCC has engaged you to prepare the adjusted Trial Balance, Classified Balance Sheet and Income Statement. They also ask you for advice on the accounting treatment and financing options for the newest version of a high-speed, colour printer. They plan to purchase the printer in January 2013.

You are provided with the following information:

a. Unadjusted Trial Balance

b. Content of the notes found in the drawer

c. Current depreciation policies for equipment and the building

d. Cost of the new printer

e. Details of the financing options

Required:

1. Prepare the Adjusted Trial Balance, Classified Balance Sheet and Income Statement for the 2012 fiscal year. Include the T-accounts for the accounts that require adjustments. Complete this requirement on accounting paper.

2. Prepare a report addressed to the owners of CCCC that:

a. Analyzes the three acceptable depreciation methods for the new printer only (i.e. straight-line, accelerated and units-of-production)

b. Recommends the preferred method to meet the owners' objective of profit maximization. Include your reasons for your recommendation

c. Analyzes the financing options

d. Recommends one of the four financing options. Explain the benefits and disadvantages of each option as part of your recommendation.

Content of notes found in the desk drawer:

A. Cost of the annual insurance policy is $12,000. The policy is effective March 1, 2012. When the invoice was paid in February 2012, the bookkeeper made the following entry:

Dr. insurance expense 12,000

Cr. Cash 12,000

B. Total salary expense for 2012 is $12,000. $6,500 had not been paid at December31, 2012.

C. $4,600 of consulting services performed in December 2012 was paid for using gift cards. Since the transaction didn't involve cash the bookkeeper didn't prepare an entry [Hint: gift cards are part of unearned revenue]

D. A new client paid CCCC a deposit of $6,000 on December 20, 2012 for a consulting engagement to begin January 15, 2013. The bookkeeper recorded the transaction as:

Dr. cash 6,000

Cr. Consulting revenue 6,000

E. The December 2012 utility bill was received on December 30, 2012. The amount of the bill was $2,700. No entry had been made.

F. The bookkeeper posted an accrual entry for the November 2012 utilities bill for $2,400. One of the owners paid the bill on December 5th and made the following entry:

Dr. utilities expense 2,400

Cr. Cash 2,400