Cost: - According to the management perspective cost is define as a reduction in the value of assets for to secure benefit or gain. In other words cost is the different expenses for to produce goods or services.

Purpose of cost accounting: - The main purpose of cost accounting is to know the cost of the business firm. It is very important to the managers to know about the cost because it helps in decision making, planning and controlling.

Lantex Manufacturing Company Limited, is a traditional textile manufacturing company which is established in 1918 and situated at Oxford Street, Lancashire BB5 1GR. The main products of Lantex are Blank Tea Towels, Cotton Canvas Bags and Cotton Drill Ap

Classification of costs: - Cost can be classified by many ways such as by elements, nature, functional and relevant. However, we are going to classified cost through element.

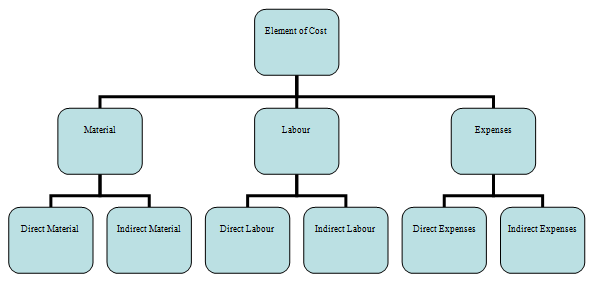

Element of cost: - According to Horngren,(2002), element of cost is consist of three element, they are material, labour and expenses. Material is the cost of goods used where as, labour is the cost of employees such as wage and salary and expenses are the costs other than material and labour including overheads. Furthermore, each element are categorised between direct and indirect. Direct costs are the costs which can be identified directly with each unit of output ie product or services, however indirect costs are the costs which can not be identified directly with each unit of output for an instance rent, rates, utility bills and transportation etc. Following figure 1.1 represents the relationship among element of cost.

Figure Horngren, 2002 : 457

Furthermore the total of Direct cost is Prime Cost and the total of Indirect cost is Overhead.

Direct cost: - Cost which can be directly identified with unit of output is known as direct cost, in addition they can be divided into three heads for an instance Direct Material, Direct Labour and Direct Expenses (Brammer and Penning, 2001).

Lantex Manufacturing Company Limited

|

Cotton Canvas Bag

|

£

|

|

Direct Labour

|

15

|

|

Direct Material

|

10

|

|

Direct Expenses

|

10

|

|

Prime cost

|

35

|

Table

Indirect cost: - Cost which can not be attributed directly with unit of output is known as indirect cost, furthermore it can be divided into Indirect Material, Indirect Labour and Indirect Expenses (Brammer and Penning, 2001).

Lantex Manufacturing Company Limited

|

Cotton Canvas Bag

|

£

|

|

Indirect Labour

|

05

|

|

Indirect Material

|

05

|

|

Indirect Expenses

|

10

|

|

Overheads

|

20

|

Table

Therefore the cost per unit of Cotton Canvas Bag is Prime cost (35) + Overhead (20) = £55

Planning: - In the words of Fayol (2003), planning is a plan or action to be followed, steps to go through and method to use to achieve objective of an organisation. Planning involves deciding in advance, what has to be done, who is going to do and when. The main purpose of planning is to keep activities on continuous flow.

Controlling: - According to Weaver and Weston, (2001) controlling is the main task of production and operation managers for maintaining demand and quality of the product. In other words controlling refers to coordinating of employees, materials and machine. For an instance a watch factory must product 80,000 watch during January. Production control manager break down this total into daily production unit for an example 4,000 watches a day, next determine the number of workers, raw materials and the machine to meet the production unit.

Decision making: - Pennings, (1986) says that managers need to take decisions according to the companies past records and current situation. Cost classification is also one of the vital and useful report for managers for making decions.

Absorption Costing: - In the words of Armstrong (2003), Absorption costing is also known as full costing. Under absorption costing all production costs are included when calculating cost per unit of product or service for an instance direct material, direct labour, variable overheads and fixed cost. Furthermore, all administration and sales expenses are also take into account.

Lantex Manufacturing Company Limited

Cost statement (per unit)

|

Cotton canvas bag

|

£

|

|

Variable cost

Direct material

Direct labour

Direct expenses

Prime cost

Total variable overheads

Fixed cost per unit

Total cost per unit

|

10

15

10

35

10

30

75

|

Marginal Costing: - According to Armstrong (2003), under marginal costing variable cost are only charged to the cost unit of the product or service, where as fixed costs are written off as a contribution for that period of time. Similarly according to Chartered Institute of Management Accounting (CIMA), London stated that Marginal costing is the additional cost incurred for an increase in one additional unit of output. Marginal costing provides useful data for managers to take decision, it increase profit on the short run, it is very simple and easy to understand as well as very simple to operate further more it is useful for short term pricing decision. Despite it has some draw backs for an instance there is a danger that products will be sold on an ongoing basis at a marginal contribution which fails to cover fixed cost and With the development of technology in the industry fixed cost has great impact on the cost of product or service and all most impossible to ignore, therefore marginal costing technique fails to reflect the impact of fixed cost on the cost of output

In conclusion marginal costing is not the proper technique for calculating cost per unit of output, because it did not cover or include fixed cost. However it is useful when company is not running its full capacity.