Reference no: EM13380640

Your first assignment requires you to become a finance advisor tasked with offering your opinion regarding four potential investments:

Investment 1. Establishing and operating a consulting service expecting to service long-term growth.

Investment 2. Establishing and operating a small fashion store expecting to profit from a passing fad.

Investment 3. Invest into a portfolio of preferred stocks paying a fixed annual income.

Investment 4. Establishing and operating a fast food franchise.

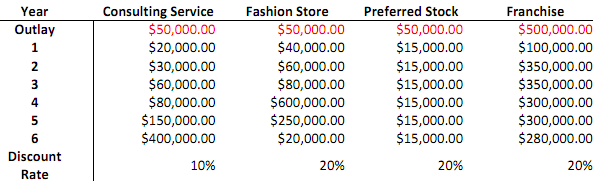

All the projects have the same initial outlay of $50,000 except for the franchise option requiring an initial outlay of $500,000. The cash flows from each project are as follows:

Calculate the NPV, IRR, and Non-Discounted Payback Period using Excel. (Note: The Non-Discounted Payback Period is simply the number of years needed to operate as to recover the initial outlay.) Take a stance on which option provides the best investment given a desired rate of return of at 40%. Take a stance on which option provides the worst investment given a desired rate of return of at 40%. You may want to use Excel's NPV() and IRR() functions to figure NPV and IRR.

The Task

Your assignment is to create a 5-page argumentative/persuasive research paper given one of the following options:

Option 1. Argue for or against the best or worst investment choices.

Option 2. Argue for or against the acceptance of a rejected investment.

Option 3. Argue for or against the acceptance of two projects rather than one project.

The paper should cite approximately three peer reviewed full text journal articles retrieved from ProQuest, BE & T, InfoTrac, and Academic OneFile. Your paper should integrate at least the following elements:

- The presentation of a firm position regarding your stance or theory.

- An offering of a strong position using evidence-based argumentation.

- An address of opposing points as to present a well-rounded argument controlling personal biases and strengthening your argument while diminishing the opposition's points.

- An effort to use evidence and argument flow as to instill a sense of trust into your reader.

Do you feel stuck while planning your argument? If so, then try jumpstarting the assignment by using the following steps:

1. Choose a stance you believe in and write down why you believe in the stance.

- Ask yourself the following questions:

- Who is my audience and which points will they be interested in?

- What kind of tone am I assuming for my argument?

- Does my tone match the audience? (If not, consider changing your tone.)

- Am I engaging in a fallacy or illogical stance? (Make sure you make sense or no one will believe you!)

- Would someone agree or disagree with me given my points? (Argue with yourself as to find the strengths and weaknesses of your stance.)

- Am I making a moral or cultural argument? (If so, you may need to reconsider a stance able to utilize scholarly literature.)

- Can I research my stance? (If not, you may need to consider a new stance.)

2. Research as to find the evidence needed to support your stance or theory. Seek the needed facts, quotes, and existing research you can use for your argument

3. Outline and write the essay starting with the evidence-supported defense of your points and slowly transition into an address of opposing points.

4. Provide a brief summary of the argument as to conclude the essay.

Download:- fin.rar