Reference no: EM13372967

You must work alone to complete this quiz. Do not share answers or ideas with other students. Write your answers, including all necessary derivations, in the spaces provided on these pages. You may use separate pages for your scratch work, but submit only these quiz pages. This quiz is due at the beginning of the class session on Tuesday, March 4, 2014.

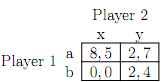

1. Consider the following normal-form game:

(a) Find and report all of the (pure-strategy) Nash equilibria of this game.

Nash equilibria:

(b) Consider the two-period repeated game in which this stage game is played twice and the repeated-game payoffs are simply the sum of the payoffs in each of the two periods. Is there a subgame perfect equilibrium of this repeated game in which (a, x) is played in the �rst period? If so, fully describe the equilibrium. If not, explain why.

2. Consider a repeated game between a supplier (player 1) and a buyer (player 2). These two parties interact over an in�nite number of periods. In each period, player 1 chooses a quality level q 2 [0; 5] at cost q. Simultaneously, player 2 decides whether to purchase the good at a �xed price of 6. If player 2 purchases then the stage-game payoffs are 6 q for player 1 and 2q 6 for player 2. Here player 2 is getting a bene�t of 2q. If player 2 does not purchase, then the stage game payoffs are q for player 1 and 0 for player 2. Suppose that both players have discount factor �.

(a) Let a2 be player 2's action in a period, where a2 = P denotes \purchase" and a2 = N denotes \not purchase." What is the Nash equilibrium of the stage game?

q* =

a�2* =

(b) For su�ciently large �, does this game have a subgame-perfect Nash equilibrium that yields the e�cient outcome in each period? If so, describe the equilibrium strategies and determine how large � must be for this equilibrium to exist.

Circle one: YES NO

If yes, need � δ ≥� δ' =

3. Consider a game in which two �rms (players 1 and 2) produce a homogeneous good and compete in a market. The game takes place in two stages. In the �rst stage, the �rms simultaneously choose whether to invest (I) or not (N). Investing entails an immediate cost of 10, whereas not investing costs nothing. The �rms observe each others' investment choices. In the second stage, the �rms compete by simultaneously choosing nonnegative quantities (q1 for player 1 and q2 for player 2), and the market price is determined by the inverse demand curve p = 9-q1 - q2. (Note that the second stage is a Cournot model of competition.) For any player i, let j denote the other player. Player i's pro�t, not including any investment cost, is

ui = (9-qi - qj) qi - ciqi;

where ci is player i's constant marginal cost of production. Player i's marginal cost depends on whether this player invested earlier. If player i invested earlier then ci = 0, whereas ci = 3 if player i did not invest. A �rm's payo� in the entire game is its pro�t in the second stage minus any investment cost that it incurred in the �rst stage.

(a) How many proper subgames does this game have?

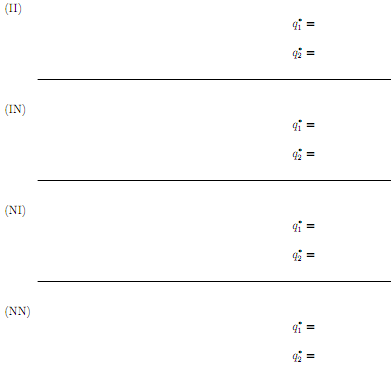

(b) Calculate the unique Nash equilibria of the subgames that start in the second stage.

Note that there are four contingencies to examine: (II) both players invested in �rst stage, (IN) only player 1 invested in the �first stage, (NI) only player 2 invested in the �rst stage, and (NN) neither player invested.

3. (c) Calculate the payoffs (including the investment costs) for the equilibria you found for part (b). Write these values in the matrix below to summarize the continuation values conditional on the actions chosen in the �rst stage.

(d) Calculate and report all of the pure-strategy subgame perfect Nash equilibria of the full game.