Reference no: EM131537862

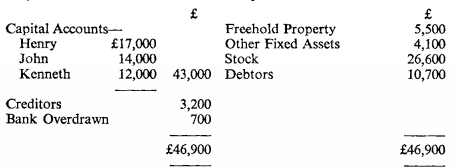

Question: Up to 31st March, 1959, Henry, John and Kenneth had been trading in partnership and sharing profits in the respective proportions of 8, 7 and 5, and the firms balance sheet drawn up as on that date was as follows:

Re-printed by courtesy of the Association of Certified Accountants (A.C.C.A.).

Re-printed by courtesy of the Royal Society of Arts (R.S.A.).

Henry having given notice that he wished to retire on the date mentioned, and it having been determined to admit Lambert as a new partner on the following day, the following terms were agreed:

(a) The balance sheet was to be revised, before the change, by writing up the book value of the freehold property to £7,500, and £200 was to be set aside as a provision against doubtful debts.

(b) Henry was to be credited with £3,000 for his share of Goodwill. He was to be paid £5,000 out of money to be brought in by Lambert, and agreed to leave the balance of the sum remaining due to him as a loan to the firm.

(c) Lambert was to bring in £7,000 in cash and to be entitled to one-fifth of the profits, the other partners, as between themselves, sharing the balance in the same proportion as before.

(d) Finally, adjustments were to be made between the partners' capital accounts to give effect to their agreement that Lambert should purchase one-fifth of the firm's Goodwill, which was to be valued for this purpose at £9,000. No Goodwill account was to appear in the books of the new firm.

Write up the partners capital accounts, showing the entries recording the foregoing, and draw up an initial balance sheet for the new firm.