Reference no: EM132409404

Assignment

Follow the steps outlined in Appendix A and download the daily stock return time series of Colgate-Palmolive from WRDS. Next, open Kenneth French's homepage and download the "Fama/French 5 Factors (2x3) [Daily]". The file contains the daily time series of the five factors Fama and French (2015, 2016) propose as an extension of their conventional three- factor model in which they suggest two new factors: operating profitability and investment.

Thus they consider the following five factors: We have attached the excel files daily returns (Colgate), fama_french

ReM,t (Market Minus Risk-free): the simple average return on the market minus the simple average risk-freerate.

SMBt (Small Minus Big): the simple average return on the portfolio containing small stocks minus the simple average return on the portfolio containing big stocks.

HMLt (High Minus Low): the simple average return on the portfolio containing value stocks minus the simple average return on the portfolio containing growth stocks.

RMWt (Robust Minus Weak): the simple average return on the portfoliocontaining stocks with robust operating profitability minus the simple average return on the portfolio containing stocks with weak operating profitability.

CMAt (Conservative Minus Aggressive): the simple average return on the portfolio con- taining stocks with conservative investment strategies minus the simple average return on the portfolio containing stocks with aggressive investment strategies.

Moreover, the last column contains the daily time series of the simple return on the U.S.- Treasury bill with one month to maturity which we will use as a proxy for the risk-freerate in this exercise. Note that the Fama-French factors and the risk-free rate are expressed in percentage points whereas the returns on Colgate-Palmolive are

(a) Use the five Fama-French factors at time t as the independent variables and the excess return of Colgate-Palmolive at time t as the dependent variable, i.e., run the following regression:

ReCP,t= β1+ β2 ReM,t + β3 SMBt + β4 HMLt + β5 RMWt + β6 CMAt + uCP,t.

Summarize the parameter estimates, their t-statistics, and the adjusted R2 in a table in your solution paper. Based on a significance level of 5%, which of the variables are statistically significantly different from zero? Is there a variable you would consider deleting from the regression? Explain your answer. For each variable which is statistically signif icant, provide an assessment of its economic significance by looking at the impact of a one-standard deviation change in the corresponding independent variable.

(b) For each of the following hypotheses, write down the restricted regression, and provide an economic interpretation. Perform each test using a significance level of 5% and report its results in your solution paper.

i. H0: β2 = 0 and β3 = 0 and β4 = 0 and β5 = 0 and β6 = 0 vs.

H1: β2 ≠ 0 or β3 ≠ 0 or β4 ≠ 0 or β5 ≠ 0 of β6 ≠ 0

For this test, illustrate in detail the steps underlying this test and explain your results from an economic point of view.

ii. H0: β3 = 0 and β4 = 0 and β5 = 0 and β6 = 0 vs.

H1: β3 ≠ 0 or β4 ≠ 0 or β5 ≠ 0 or β6 ≠ 0

iii. H0: β4 = 0 and β5 = 0 and β6 = 0 vs.

H1: β4 ≠ 0 or β5 ≠ 0 of β6 ≠ 0

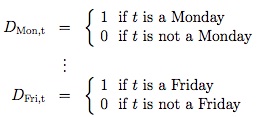

(c) You are wondering whether the stock return of Colgate-Palmolive is different for a specific day of the week. Hence, you define the following dummy variables, one for each day of the week:

For instance, the Monday dummy variable at day t will be equal to one (DMon,t = 1) if and only if t is a Monday. If this is not the case, the dummy variable will be equal to zero (DMon,t = 0).

Use the five Fama-French factors at time t as well as the five dummy variables at time t as independent variables and the excess return of Colgate-Palmolive at time t as the dependent variable, i.e., run the following regression without a constant:

ReCP,t= β2 ReM,t + β3 SMBt + β4 HMLt + β5 RMWt + β6 CMAt + β7 DMon,t + β8 DTue,t + β9 DWed,t + β10 DThu,t + β11 DFri,t + uCP,t.

so that the dummy variables altogether capture the missing constant. Summarize the parameter estimates, their t-statistics, and the adjusted R2 in a table in your solution paper. Based on these results, can you provide an economic interpretation for the coefficients of the dummy variables that are statistically significantly different from zero?

Attachment:- Finance Management.rar