Reference no: EM131020544

Quiz 3-

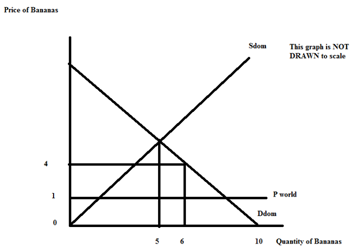

In answering this question refer to the figure below. The figure depicts the market for bananas in a small, closed economy. The figure also provides the world price of bananas, $1. Assume that both the demand and the supply curves are linear in this market.

a. Given the above figure, write an equation for the domestic demand curve, Ddom. Show your work.

b. Given the above figure, write an equation for the domestic supply curve, Sdom. Show youar work.

c. Given the above figure, if this market for bananas opens to trade, what is the value of consumer surplus, CSopen? Show your work.

d. Given the above figure, if this market for bananas opens to trade, what is the value of producer surplus, PSopen? Show your work.

e. Suppose the market for bananas opens to trade, but a tariff is placed on bananas so that the price of the bananas with the tariff is now $3. How many bananas will be imported with this tariff? Show your work.

f. Given the tariff described in (e), what is the value of consumer surplus with the tariff, CStariff? Show your work.

g. Given the tariff described in (e), what is the value of producer surplus with the tariff, PStariff? Show your work.

h. Given the tariff described in (e), what is the value of government tariff revenue with the tariff, Govt. Tariff Rev.? Show your work.

i. What is the value of total surplus with the tariff, TSsurplus? Show your work.

j. What is the value of the deadweight loss due to using a less efficient, higher cost producer? Show your work.

|

What is the current price of the common stock

: McGaha Enterprises expects earnings and dividends to grow at a rate of 25% for the next 4 years, after the growth rate in earnings and dividends will fall to zero, i.e., g = 0. The company's last dividend, D0, was $1.25, its beta is 1.20, the market ..

|

|

Should the investor acquire the stock

: Company XYZ's preferred stock is selling for $26 in the market and pays a $2.60 annual divident. If the market's required yield is 11%, what is the value of the stock for that investor? Should the investor acquire the stock?

|

|

Evaluate arts decision-making skills

: Read the case study titled "Meet Art" on page 147 in our textbook. How would you evaluate Art's decision-making skills? What would you have done differently? In this case study, how would you evaluate Joan's response to Art's request to move to Calif..

|

|

What is the present value-discount rate

: What is the present value (PV) of $359,000 that is to be received at the end of 23 years if the discount rate is 11 percent? How would your answer change in Part (a) if the $359,000 is to be received at the end of 20 years?

|

|

Write an equation for the domestic demand curve

: Given the above figure, write an equation for the domestic demand curve, Ddom. Given the above figure, write an equation for the domestic supply curve, Sdom. Show youar work

|

|

What must be true about the price elasticity of demand

: According to the author of the article: "For this publisher, that means less revenue and less profit as some buyers reject the more expensive books." Does the fact that some buyers will no longer buy the publisher's books at a higher price necess..

|

|

What is the equipments after-tax salvage value

: Southern California Gas Co. is selling off some old equipment it no longer needs because its associated project has come to an end. The equipment originally cost $27,500, of which 75% has been depreciated. The firm can sell the used equipment today f..

|

|

What is the limit of c as n increases without bound

: Find the value of c when n = 5, n = 6. Graph c as a function of n. What is the limit of c as n increases without bound?

|

|

Assuming for simplicitys sake-resumption for productivity

: Applying the 1.7 extra minutes per discharge, we estimated it would take an extra 425 minutes (1.7 times 250) to code the discharges in the first month. At $50 per hour, the cost per minute is $0.83 ($50 divided by 60 minutes) and the cost per claim ..

|