Reference no: EM131245410

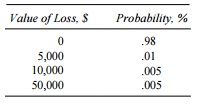

(Our thanks to David Pyle, University of California, Berkeley, for providing this problem.) Mr. Casadesus's current wealth consists of his home, which is worth $50,000, and $20,000 in savings, which are earning 7% in a savings and loan account. His (one-year) homeowners insurance is up for renewal, and he has the following estimates of the potential losses on his house owing to fire, storm, etc., during the period covered by the renewal:

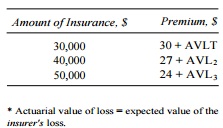

His insurance agent has quoted the following premiums:

Mr. Casadesus expects neither to save nor to dissave during the coming year, and he does not expect his home to change appreciably in value over this period. His utility for wealth at the end of the period covered by the renewal is logarithmic, i.e., U(W) = ln(W).

a) Given that the insurance company agrees with Mr. Casadesus's estimate of his losses, should he renew his policy (1) for the full value of his house, (2) for $40,000, or (3) for $30,000, or (4) should he cancel it?

b) Suppose that Mr. Casadesus had $320,000 in a savings account. Would this change his insurance decision?

c) If Mr. Casadesus has $20,000 in savings, and if his utility function is

U( W) = - 200,000 W

should he renew his home insurance? And if so, for what amount of coverage?

Note: Insurance covers the first x dollars of loss. For simplicity, assume that all losses occur at the end of the year and that the premium is paid at the beginning of the year.]

|

Concept of development economics-traditional economic growth

: How do you distinguish between the concept of development economics and that of traditional economic growth? Do you agree with the notion of many economists who contend that the development economics is greater in scope than traditional economics? Wh..

|

|

Discuss your dominant strategy for the situation

: Think of a time when you were involved in strategic decision making. This could be a business situation or a personal situation. It could be anything from purchasing inputs for a manufacturing firm to trying to divide up household chores. Discuss you..

|

|

Derive the formula for generating random numbers

: The so-called 2-parameter Weibull distribution is defined as follows: F(x) = 1-e-(x/b)a. Using the inverse transform method, derive the formula for generating random numbers for the two-parameter Weibull distribution, where a=3 and b=0.9

|

|

Which stage of typical financial reimbursement cycle

: Payments to hospitals from private insurers can be characterized as having reached which stage of a typical financial reimbursement cycle? Which of the following statements about the certificate of need legislation is false? The wealthiest group in A..

|

|

Would this change his insurance decision

: Suppose that Mr. Casadesus had $320,000 in a savings account. Would this change his insurance decision? -should he renew his home insurance? And if so, for what amount of coverage?

|

|

Write a post order traversal function for general trees

: Write a function that takes as input a general tree and returns the number of nodes in that tree. Write your function to use the Gen Tree and GT Node ADTs of Figure 6.2.

|

|

Distinction between good nervousness and bad nervousness

: Many musicians and performers make a distinction between "good nervousness" and "bad nervousness". What do you think this distinction means? How does it apply to public speaking?

|

|

How to implement the weighted union rule efficiently

: Describe how to implement the weighted union rule efficiently. In particular, describe what information must be stored with each node and how this information is updated when two trees are merged. Modify the implementation of Figure 6.4 to support..

|

|

Which contributed to the improvement of medieval agriculture

: Which of the following contributed to the improvement of medieval agriculture? The world's various trading cities during the Abbasid caliphate, such as Córdoba, Madrid, and Baghdad, would best be described as.

|