Reference no: EM131489855

Question: The NYSE

Starting Small: On a warm May afternoon in 1792, 24 New York City stockbrokers and merchants met beneath a buttonwood tree to sign an agreement.

This deal- the Buttonwood Agreement-marked the creation of the New York Stock Exchange (NYSE) and Growing Big.

Today the 37,000-square-foot floor of the New York Stock Exchange is where the action is. Although some shares are traded electronically, traders on the floor of the exchange match buyers and sellers of listed stocks in a daily high-stakes dance. Companies pay an initial fee of up to $250,000 just to be listed on the NYSE, and yearly listing fees can reach $500,000. The NYSE, also called the "Big Board," serves as auctioneer for about 2,600 U.S. and foreign companies. It also works to earn a profit for its own shareholders. After nearly 214 years as a notfor-profit exchange, the NYSE went public on March 8, 2006, selling shares in itself. It also

merged with Archipelago Holdings Inc. and the Pacific Exchange to become the NYSE Group, the largest stock exchange ever.

Competition From Abroad

After corporate accounting scandals such as Enron were made public in the early 2000s, Congress and the Securities and Exchange Commission instituted the Sarbanes-Oxley Act in 2002. SarbOx created reams of new rules and regulations aimed at eliminating corporate corruption. The fallout from SarbOx has led many investors, companies, and even the NYSE Group itself to look to overseas exchanges, where regulations are less strict. In May 2006, the NYSE announced its $10 billion intention to merge with Euronext, which runs the Amsterdam, Brussels, Paris, and Lisbon exchanges. By merging with Euronext, the NYSE can bypass the red tape created by SarbOx and tap into new markets.

Analyzing the Impact Question

1. Summarizing Why did the NYSE decide to expand into overseas markets?

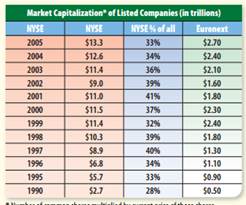

2. Analyzing Visuals Look at the market capitalization table. What has happened to NYSE's share of market capitalization since the enactment of SarbOx?

|

Why would someone be willing to invest in junk bonds

: The BIG Idea Why would an investor want to choose a certificate of deposit over a corporate bond?

|

|

What do corporate bonds and municipal bonds have in common

: Comparing and Contrasting What do corporate bonds, municipal bonds, and government savings bonds have in common? How do they differ?

|

|

Discuss the interests that might win or lose

: Discuss the interests that might win or lose, depending on the outcome. What are their resources, and what is their likely position?

|

|

Explain the risk-return relationship

: Risk-Return Relationship If you had money to invest, which financial asset or assets, if any, would you choose? Explain your answer in a brief paragraph.

|

|

Why did the nyse decide to expand into overseas markets

: Starting Small: On a warm May afternoon in 1792, 24 New York City stockbrokers and merchants met beneath a buttonwood tree to sign an agreement.

|

|

What are the specific advantages of cloud computing for erp

: DQ #2: Cloud Computing- What are the specific advantages and disadvantages of cloud computing for enterprise resource planning (ERP)?

|

|

What property exhibited by water causes this

: Water plays a critical role in weather pat- terns and climate. What property exhibited by water causes this?

|

|

Explain the significance of equities and stockbroker

: Explain the significance of equities, stockbroker, Efficient Market Hypothesis, portfolio diversification, mutual fund, net asset value, 401(k) plan, stock.

|

|

Explain influence that corporate social responsibility has

: Select a business decision within the organization. Evaluate the influence that corporate social responsibility has on the organization.

|