Reference no: EM131020921

Second Midterm-

MULTIPLE CHOICE QUESTIONS:

1. Economists believe that with regard to interest group politics it is

a. Better to be a member of a large group interested in the given policy than a member of a small group interested in the given policy.

b. Better to be a member of a small group interested in the given policy than a member of a large group interested in the given policy.

c. Better if you can spread the costs of the proposed policy over a large group of people.

d. Answers (a) and (c) are both correct.

e. Answers (b) and (c) are both correct.

2. George Stigler won a Nobel Prize in Economics in 1982 for his counterintuitive work on the concept that firms and business actually benefit from regulation. Mr. Stigler argued that

a. Teachers' unions favor stringent regulation of potential new teachers because it results in less competition for already employed teachers.

b. Regulation of the entry of new teachers into the educational system benefits teachers and not students.

c. Regulation of the entry of new teachers into the educational system is an effective barrier to entry.

d. Answers (a), (b) and (c) are all true answers.

e. Answers (b) and (c) are true answers.

3. When a tornado is sighted in the Madison area, sirens go off to warn people to seek shelter. The sound of the siren is ______________ and ___________________.

a. Excludable; rival

b. Non-excludable; rival

c. Excludable; non-rival

d. Non-excludable; non-rival

4. The fish in Lake Mendota are best described as

a. Private goods

b. Club goods

c. Common Resources

d. Public Goods

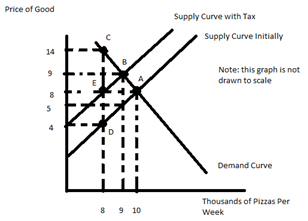

Use the information below to answer the next FOUR (4) questions.

The city council of Madison decides that eating too much pizza is bad for one's health. To discourage eating pizza they levy an excise tax (a tax per pizza) on the producers of every pizza sold in Madison. The figure below shows the supply and demand in the market for pizza in Madison before the tax and after the imposition of the tax.

5. The imposition of an excise tax of $4on pizza in Madison will cause the price of pizza in Madison to ______________________ by _________________.

a. Increase; the amount of the excise tax

b. Increase; less than the amount of the excise tax

c. Increase; more than the amount of the excise tax

d. Decrease; less than the amount of the excise tax

e. Decrease; more than the amount of the excise tax

6. After the excise tax is imposed, the price per pizza paid by consumers is __________, the net price per pizza received by producers (this is the price per pizza minus the excise tax) is _______________, and the quantity produced is ____________pizzas per week.

a. $8; $8; 10,000

b. $5; $9; 9,000

c. $9; $5; 9,000

d. $14; $9; 9,000

e. $9; $14; 8,000

7. The imposition of the excise tax reduces the number by pizzas produced by ____________ per week, and causes a deadweight loss of _______________ per week.

a.1,000; $45,000

b. 1,000; $22,500

c. 2,000; $8,000

d. 1,000; $4,000

e. 1,000; $2,000

8. A group of students starts a campaign to rebel against the Madison pizza excise tax by persuading every pizza eater in Madison to eat exactly the same amount of pizza as before the tax. Suppose they succeed in this so that the quantity demanded is the same regardless of the excise tax. An economic analysis of the impact of the excise tax on this market given this successful campaign and holding everything else constant would show that the campaign resulted in the demand curve for pizzas in Madison becoming perfectly ____________; the consumers in the market bearing _______ of the economic incidence of the excise tax; and the pizza producers in the market bearing ________ of the economic incidence of the excise tax.

a. Inelastic; all; none

b. Inelastic; none; all

c. Elastic; all; none

d. Elastic; none; all

e. Inelastic; half; half

9. Consider the following information about an economy in 2012:

- George a realtor sells 10 houses built between 1990 and 2009 for a total of $1,000,000 and collects 10% of this amount as a commission on his efforts

- Harry runs a gambling operation where customers can place bets on the outcomes of different athletic events: he makes $50,000 in 2012 and does not report any of this income to government authorities

- Susie exchanges babysitting services with Stan: since they both provide services to each other they do not pay for these services: the value of these services is $30,000 for 2012

- Ace Car Manufacturing manufactures 4000 cars in 2012 and sells 3500 of these cars: the price of each car is $20,000

- Swift Tires manufactures 20,000 tires and provides Ace Car Manufacturing with 16,000 tires for the new cars; the rest of the tires are sold as replacement tires and each tire is sold for $100

GDP in 2012 in this economy given the above information would equal

a. $82,680,000

b. $80,500,000

c. $82,100,000

d. $82,600,000

The following information applies to the next TWO (2) questions.

Education and basic literacy are generally thought to have value to society in a democracy because education enables citizens to be better informed. Hence governments have often provided publicly funded and publicly operated schools. Another approach is a "voucher program", in which the government gives parents a voucher that represents an amount of money they can apply toward tuition at a private school for their children. News item:

The 2013-15 state budget [has] expanded the school voucher program, which had previously been limited to Milwaukee and Racine [: it now covers] school districts across the state. Just over 2,000 students applied to receive vouchers at schools participating in the new program.

10. Education

a. Provides a positive benefit to society and therefore cannot be an externality.

b. Is a positive externality because it provides extra benefits to society beyond the private benefitsof consuming the good.

c. Must be provided by a government-run school in order to be considered a "public good".

d. Should be taxed because it involves an externality.

11. Education via a voucher system

a. Allows government to subsidize education while not necessarily operating the school system that provides the education.

b. Allows government to operate the school system.

c. Prevents people who pay taxes and send their children to private school from receiving a subsidy for educating their children.

d. Corrects a market failure because the private benefit to education means government should subsidize it.

e. Should include a tax on the value of the voucher to offset the externality.

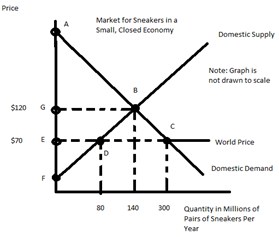

Use the following figure of the market for sneakers in a small, closed economy to answer the next FOUR (4) questions.

12. In the closed economy depicted in the above graph, the domestic price of a pair of sneakers is ______ and the domestic output of sneakers is ___________ pairs of sneakers per year.

a. $70; 220 million

b. $70; 300 million

c. $70; 80 million

d. $120; 140 million

13. Again suppose the market for sneakers in the above graph is opened to trade. Then ____________ pairs of sneakers are ________________ this domestic economy.

a. 220 million; exported out of

b. 300 million; exported out of

c. 220 million; imported into

d. 300 million; imported into

e. 80 million; imported into

14. In the above graph, if this small, closed economy is open to trade in sneakers, then total surplus (consumer surplus plus producer surplus) will be the area _______, consumer surplus will be the area _________ and producer surplus will be the area ____________

a. ABF; ABG; GBF

b. ABF; ABG; EDF

c. ABCDE; GEFDB; ACE

d. GBDE; EDG; GBDFE

e. AEC+EDF; AEC; EDF

15. Consider the market in the above graph again. Table 1 shows preference rankings for having that market open to trade, closed to trade, or limited by a tariff or quota.

|

Table 1

|

|

Preference

Rank*

|

Choice #1

|

Choice #2

|

Choice #3

|

Choice #4

|

|

1

|

Open

|

Closed

|

Tariff/quota

|

Open

|

|

2

|

Tariff/quota

|

Tariff/quota

|

Open

|

Closed

|

|

3

|

Closed

|

Open

|

Closed

|

Tariff/quota

|

* "1" is most preferred, "3" is least preferred

Given this information, domestic consumers would prefer ranking ___ and domestic producers would prefer ranking ______.

a. Choice #1; Choice #2

b. Choice #1; Choice #4

c. Choice #2; Choice #1

d. Choice #2; Choice #3

Use the following information for the next TWO (2) questions.

Violent clashes between employees of a mining company and protestors have recently occurred in Wisconsin. News item: "It all began when a company called Gogebic Taconite, or G-Tac, got permission to test the soil in northern Wisconsin's Penokee Hills area for minerals, including iron ore. The company eventually wants to carve a 4-mile open pit mine through the heavily wooded area." Protestors fear contamination of ground water, silting and destruction of streams, and ecological damage.

16. Given the above information, which of the following statements is correct?

a. The market will automatically take into account environmental damage in the price that customers of the mine pay for the iron the mine produces.

b. The supply curve of iron produced by the company will automatically include the cost of any environmental damage.

c. The environmental damage that may occur is a negative externality.

d. An externality occurs here but the externality in this case isnot a form of market failure.

e. Competition will insure that public and private costs associated with the iron produced from this mine will be equal.

17. To internalize the cost of environmental damage, policy could

a. Subsidize the production of the iron ore.

b. Tax the iron ore to reflect the social costof producing the iron ore.

c. Tax the iron ore as long as this did not raise the market price that the buyers pay for the iron ore.

d. Subsidize the production of the iron ore as long as this did not lower the market price that the buyers pay for this iron ore.

e. Do nothing because competition will insure that externalities will be internalized (taken into account) by the market.

18. If one country's GDP deflator grows by 4 percent from 2012 to 2013 and its real GDP grows by 3 percent, then this country's nominal GDP will

a. rise by approximately 1 percent.

b. fall by approximately 1 percent.

c. rise by approximately 7 percent.

d. change, but the direction and magnitude depend on its initial level of GDP.

19. At UW, the Camp Randall Memorial Sports Center (the Shell) is a popular recreational facility, which typically has plenty of space to work outin while requiring its users to pay a user fee each year. The Shell has the characteristics of a

a. Private good

b. Club good

c. Common resource

d. Public good

20. Social security benefits to retirees are paid primarily from:

a. The funds saved from your Social Security contributions while you were working.

b. Required contributions to social security from currently employed workers.

c. General tax revenues.

d. Individual Retirement Accounts.

e. Public and Private defined contribution plans.

21. U.S. Adults age 65 and over get their income from various sources. In order of the size of the income from each source, the largest amount comes from ___________, the second largest comes from __________, and the third largest comes from ______________.

a. Social security; public and private defined benefit plans (excluding Social Security); earnings from work

b. Social security; earnings from work; public and private defined benefit plans (excluding Social Security)

c. Public and private defined benefit plans (excluding Social Security); Defined contribution plans and Individual Retirement Accounts; Social Security

d. Public and private defined benefit plans (excluding Social Security); social security; earnings from work

e. Defined contribution plans and Individual Retirement Accounts; Social Security; Public and private defined benefit plans (excluding Social Security)

22. To get the highest participation rate and the highest savings rate in a defined contribution retirement plan, the plan should have choice architecture set up so that:

i) For the employee's decision whether to participate in the plan, the default is _________ and the option is to _____________. And,

ii) For the employee's decision now on whether to increase contributions when receiving pay raises in the future, the default is __________ and the option is to ___________.

a. Participate; opt in; do not increase; opt in

b. Do not participate; opt in; Do not increase; opt out

c. Participate; opt out; increase; opt out

d. Do not participate; opt in; Increase; opt out

e. Participate; opt in; do not increase; opt in

23. Suppose you have a target of $800,000 you want to accumulate for retirement. Suppose you would earn a constant 5% a year after inflation over 40 years on your savings while working, and that this would mean that you would need to save about $6,720 a year to reach your goal. To accomplish this, whataverage annual income would you need to earn per year during your working years if you saved 10% of it every year?

a. $6,720

b. $672

c. $20,000

d. $168,000

e. $67,200

24. Of the five possible elements listed below, which three are in both the Affordable Care Act (Obamacare) and the Massachusetts plan adopted under Governor Romney?

The five possible elements to choose from are:

1) All Americans should have access to affordable health insurance, even if they have pre-existing medical problems

2) All Americans should have access to affordable health insurance, unless they have pre-existing medical conditions

3) People should be induced or required to buy health insurance even if they are currently healthy, so that the risk pool remains reasonably favorable

4) To prevent the health insurance "mandate" from being too onerous, there should be subsidies to hold premiums down as a share of each person's income.

5) To prevent the health insurance "mandate" from being too onerous, healthy people should be allowed forego insurance coverage

a. 1, 3, 4

b. 2, 3, 4

c. 1, 4, 5

d. 2, 4, 5

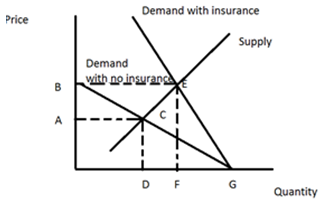

Use the following Figure to answer the NEXT question:

In this figure the demand curve with insurance assumes a straight cost to the consumer of 20% of the actual price; the insurance company would pay the other 80%.

25. With insurance, the equilibrium quantity and price of health care would be at Point ____, where the price is _____ and the quantity is ___________ than the equilibrium with no insurance at Point______.

a. C, lower, lower, E

b. E, higher, higher, C

c. C, higher, higher, E

d. E, higher, lower, C

e. C, lower, higher, E

Use the following information for the next question:

It costs a health care provider more to provide health care services in the emergency room than during regular hours at the doctors' office, so they charge the patient more for emergency room visits. Suppose for example that a patient would pay $250 to get a service at the emergency room that would cost only $150 during regular hours in the doctor's office.

With this background consider two situations. In Situation #1 a person has no health care insurance. They are sick on a weekend, but wait until Monday to see the Doctor because it is not an emergency and it is cheaper to wait for regular officer hours. In Situation #2, the same person has acquired health insurance that covers 100% of emergency room visits and 100% of visits to the Doctor during regular office hours. Again she gets sick on the weekend, but now she goes to the emergency room for treatment.

26. The situation in which people change their behavior after they get insurance (illustrated by the above scenario) because the change benefits them but increases costs to the insurer is called:

a. Death spiral

b. The insurance premium

c. Adverse selection

d. Health care reallocation

e. Moral hazard

27. A program to provide health care free to the poor, will cause: A(n) _____________in the price of health care to the _____________ and a(n) ___________ in the amount of health care the non-poor consume.

a. Increase; poor; decrease

b. Increase; non-poor; decrease

c. Increase; non-poor; increase

d. Decrease; non-poor; increase

e. Decrease; non-poor; decrease

28. Consider a private health insurance market that is unregulated except for one stipulation. No one can be turned down for insurance, based on a pre-existing condition. Then start with a pool of people for which a company provides the option of health insurance. Furthermore, assume that the cost of providing any aspect of health care remains stable. Then, because of adverse selection, the price of the insurance will _______________, and the number of people in the pool will ________________.

a. Remain stable; remain stable

b. Continually rise; continually rise

c. Continually rise; continually fall

d. Remain stable; continually rise

e. Remain stable; continually fall

29. Wormwood currently does not include discouraged workers as part of the unemployed when it computes its unemployment rate. This decision not to include discouraged workers results in

a. The unemployment rate in Wormwood being higher than it would be if the discouraged workers were included.

b. The unemployment rate in Wormwood being lower than it would be if the discouraged workers were included.

c. No impact on the unemployment rate.

d. The employment rate in Wormwood being lower than it would be if the discouraged workers were included.

30. Suppose real GDP in 2010 is $5 billion and in 2011 real GDP increases by 2%. Suppose population in 2010 is 1 million people and in 2011 population increases by 10,000 people. From this information you can conclude

a. Real GDP per capita was constant between 2010 and 2011.

b. Real GDP per capita increased between 2010 and 2011.

c. Real GDP per capita decreased between 2010 and 2011.

d. This economy is not growing fast enough to absorb the increase in population.

31. Consider the following information about an economy in 2012:

- There are 150,000 people age 16 and older in this economy in 2012

- There are 40,000 people who are retired (they are all over 65 years old) in this economy in 2012

- There are 5,000 full-time students that are age 16 and older in this economy in 2012

- There are 80,000 people age 16 and older who are working for pay full-time in this economy in 2012 in jobs they really like

- There are 4,000 people age 16 and older who are working half-time in this economy in 2012 even though they would prefer to work full-time

- There are 4,000 people age 16 and older who are working half-time in this economy in 2012 in jobs for which they are over qualified

- There are 2,000 people age 16 and older who are working for pay full-time in this economy in 2012 in jobs they really dislike

- There are 5,000 people age 16 and older who are currently not working, are available for work but who have not made a job application in the past month

- There are 10,000 people age 16 and older who are currently not working, are available for work and are actively filling out job applications

Given the above information and holding everything else constant, the unemployment rate in this economy for 2012 is equal to

a. 5%

b. 10%

c. 15%

d. 20%

e. The unemployment rate in this economy cannot be calculated given the above information.

32. Which of the following statements is true?

I. The construction of the CPI uses a fixed market basket.

II. In the base year the nominal value of a variable is equal to its real value.

III. If the CPI increases over time this implies that the real value of a variable must also increase.

a. Statements I, II and III are all true statements.

b. Statements I and II are true statements.

c. Statements I and III are true statements.

d. Statement I is a true statement.

e. Statement II is a true statement.

33. Wheelan notes that government can be both good at doing some things and quite bad at doing other things. For example,

a. Government can regulate industries to such a degree that it effectively makes it impossible for businesses to operate.

b. Government can provide for the provision of goods, like national defense, that the market would not provide.

c. Government will always redistribute an economy's income in a fair and just manner.

d. Answers (a), (b) and (c) are all true statements.

e. Answers (a) and (b) are true statements.

34. Allocation of resources by the government results in

a. Resources being allocated to their most productive uses.

b. Resources being allocated to their least productive uses.

c. Resources being allocated where they will earn the lowest return.

d. Resources being allocated wherever the political process sends them.

35. Wheelan writes about an anecdote where a lawyer proclaimed "The country cannot afford anything but Cadillac lawyers." This quote focuses on the idea that

a. Large car manufacturers, like Cadillac, are the only entities in our society that can afford lawyers.

b. Cadillacs are expensive and if we only produce Cadillacs then a lot of people will be unable to afford a car.

c. Some legal services do not require extraordinary, and expensive, legal service providers.

d. Answers (a), (b), and (c) are all true answers.

e. Answers (b) and (c) are true answers.

36. Theoretically "the market for high quality used cars will not work". This "market for lemons" was first described and analyzed by

a. George Akerlof, a professor of economics at UC-Berkeley.

b. The husband of Janet Yellen (Yellen has recently been nominated to be the new Chair of the Federal Reserve).

c. Gregory Mankiw, the author of your textbook.

d. Answers (a) and (b).

e. Answers (b) and (c).

37. McDonald's sells hamburgers and fries that taste the same at every outlet. This is

a. An example of branding.

b. McDonald's selling predictability and this known predictability can be of value to the consumer.

c. A way of McDonald's to build an element of trust with potential customers.

d. Answers (a), (b) and (c) are all true statements.

e. Answers (a) and (b) are true statements.

38. Wheelan describes the stimulus bill that was passed early in the Obama Administration as

a. "A giant legislative Christmas tree."

b. "Including funding for things ranging from "green" golf carts to a polar ice breaker."

c. "A bill that sane people could support as reasonable."

d. Answers (a), (b) and (c) are all true answers.

e. Answers (a) and (b) are true answers.

39. Asymmetric information may cause market failure. Which of the following statements is false?

a. Because advertising is costly, we usually expect that heavily advertised products will be of higher quality than those products that are never advertised.

b. New car dealers are more likely to lie than are used car dealers.

c. Employers cannot fully observe applicants' ability, but degrees from elite universities can serve as a reliable signal of high ability.

d. The moral hazard problem is stronger when insurance companies over insure a customer's asset.

40. When the optimal quantity is chosen, the most efficient outcome will be realized. Which of the following statements is true?

a. Pollution causes a negative externality, so the optimal quantity of pollution is zero units of pollution.

b. Market equilibrium determines the socially optimal quantity for each private good. But the quantity determined by the market will always exceed the socially optimal quantity if the goods are non-excludable.

c. Overfishing is irrational for individual fishermen because they should know that overfishing will lead to extinction of the fish they catch and that overfishing will eventually destroy their business.

d. Without well-defined intellectual property rights, private companies will makes fewer innovations because they will expect that some free riders in their industries will steal their new technology and take some of their market share.