Reference no: EM13325432

Pisa Pizza Parlor

Pisa Pizza Parlor is investigating the purchase of a new $44,000 delivery truck that would contain specially designed warming racks.

The new truck would have a eight-year useful life. It would save $5,900 per year over the present method of delivering pizzas.

In addition, it would result in the sale of 1,900 more pizzas each year. The company realizes a contribution margin of $1 per pizza. (Ignore income taxes.)

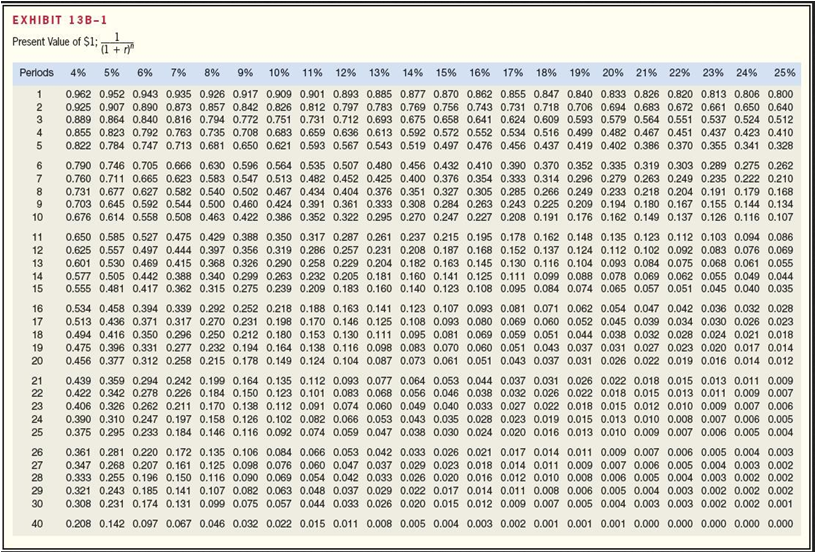

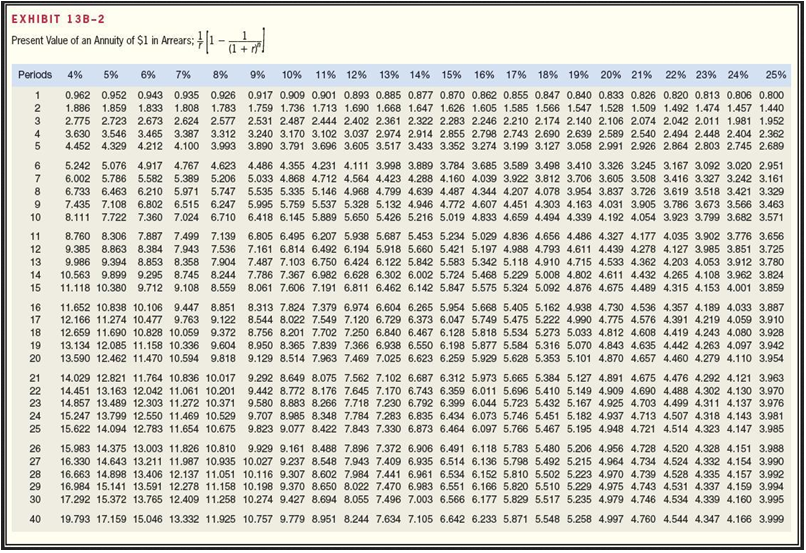

*Determine the appropriate discount factor(s) using tables.

What would be the total annual cash inflows associated with the new truck for capital budgeting purposes?

Find the internal rate of return promised by the new truck. (Round discount factor(s) to 3 decimal places and final answer to the closest interest rate.

In addition to the data already provided, assume that due to the unique warming racks, the truck will have a $19,000 salvage value at the end of eight years. Under these conditions, compute the internal rate of return.