Reference no: EM13816699

(1) The following table summarizes information which are associated with three new 3D Printers being considered for use in a manufacturing plant. Note that M&O stands for Maintenance & Operation Cost.

|

|

A

|

B

|

C

|

|

Useful Life (Years)

|

13

|

11

|

9

|

|

First Cost

|

$2,780,000

|

$2,630,000

|

$2,300,000

|

|

Salvage Value

|

$118,000

|

$97,000

|

$82,000

|

|

Annual Benefit

|

$670,000

|

$650,000

|

$580,000

|

|

M&O

|

$78,000

|

$71,000

|

$65,000

|

|

M&O Gradient

|

$15,000

|

$12,500

|

$11,000

|

The company's interest rate (MARR) is 12%. Which 3D Printer should the company choose? Use Annual Cash Flow Analysis.

(2) A used car dealer in Las Cruces placed the following advertisement: $500 down now + $99 for the first 12 months + $199 for the following 48 months

a. What is the price of the car if the interest rate is 12% per year compounded monthly?

b. If financing is done at 12% APR, what would be the equivalent uniform monthly payment?

(3) Austin, a US Crude Company engineer recommended that US Crude purchase a special tool to reduce the cost of pumping oil out of the bayous of St. Martin Parish. As a result of Austin's recommendation, US Crude purchased the tool for $300,000 on January 1, 2010. By January 1, 2011, the tool had saved a total of $45,000 and went on line full time. After going on line full time, the tool saved US Crude $90,000 each year for the next three years and Austin was happy. However, Austin recommended the "el-cheapo" model, and it started breaking down during the early part of year five, and ended up by saving only $50,000 during year five. It was scrapped as being unusable at the end of year five, and had a zero salvage value. Austin told his boss that his recommendation had been correct. Use a MARR of 10% and evaluate the effectiveness of the tool and the correctness of Austin's recommendation.

(4) You are considering two alternative plant layouts, A1 and A2, to improve its current layout. The cash flows are shown below. The first costs represent the expenses of rearranging the current layout to the alternative new layout and the annual savings represent the reduction in the production costs of the new layout compared to the current layout. Using the internal rate of return as the decision criterion, what course of action do you recommend? Use MARR = 11%.

|

Data

|

Year

|

Al

|

A2

|

|

First Cost

|

0

|

-$110,000

|

-$115,000

|

|

Annual Savings

|

1 to co

|

$12,500

|

S15.000

|

(5) Given the data in the table below, choose the better alternative-using present worth analysis if MARR is 9%.

|

Initial Cost

|

$10,000

|

$9,000

|

|

Annual Benefits

|

$5,200

|

$4,700

|

|

Annual Expenses

|

$3,000

|

$2,000

|

|

Salvage Value

|

$1,200

|

$1,300

|

|

Useful Life (Years)

|

6

|

4

|

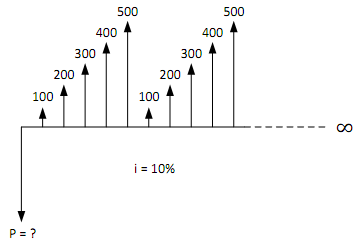

(6) Compute the capitalized cost for the following cash flows using the minimum number of compound interest factors. Note that if you do not use the minimum number of compound interest factors, there will be a 0.5 point deduction.

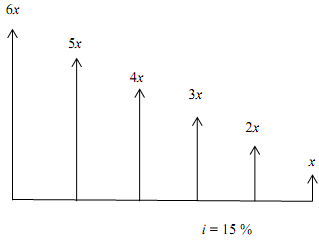

(7) Compute the future worth for the following cash flows using the minimum number of compound interest factors. Note that if you do not use the minimum number of compound interest factors, there will be a 0.5 point deduction.

(8) If you invest $1,000 today, how much will it be worth in 20 years? Assume that the money will grow at the interest rates: of 8% compounded semiannually during years 1-10, and 12% compounded quarterly during the remaining years.

|

Managing the supply chain from suppliers

: Your post should discuss the details regarding supply chain management strategies used by the company, and thoroughly explain why you think the company you choose does an excellent job managing the supply chain from suppliers, manufacturers, wareh..

|

|

Show how all the monthly payments were computed

: Show how all the monthly payments were computed by the bank. This should be computed and illustrated in Excel, using clearly labeled columns and rows.

|

|

Define global strategy include developing plans

: Some factors to be considered for a successful global strategy include developing plans for creating new products, assuring customer service and products are what customers want, and recruiting skilled employees to provide this competitive advanta..

|

|

Describe the dark side of marketing

: Examine whether marketing creates or satisfies consumer needs. Describe the "dark side" of marketing. Cite examples of companies that have compromised their ethics or values for increased sales and profits

|

|

What would be the equivalent uniform monthly payment

: What is the price of the car if the interest rate is 12% per year compounded monthly - what would be the equivalent uniform monthly payment?

|

|

Description of the organization and industry

: A brief description of the organization and industry they selected. At least four key concepts relevant to Operations Management in your organization

|

|

Impact the marketing strategies

: The American population is changing and these changes will impact the marketing strategies of all companies. Describe how household patterns in the United States are anticipated to change over the next few years

|

|

Provide specific examples of products

: For targeting new customers, examine the advantages and disadvantages of using these social networks compared to search engine advertising. Provide specific examples of products that lend themselves more to social networks than to search engine adver..

|

|

Critical components of a marketing plan

: Strengths, weaknesses, opportunities, and threats (SWOT) are critical components of a marketing plan. For this assignment, you will build a marketing plan for an organization, product, or service of your choice

|