Reference no: EM131535848

Assignment

1-The Jackson-Timberlake Wardrobe Co. just paid a dividend of $1.25 per share on its stock. The dividends are expected to grow at a constant rate of 5 percent per year indefinitely. Investors require a return of 12 percent on the company's stock

a-What is the current stock price?

b-What will the stock price be in three years?

c-What will the stock price be in 8 years?

2-The next dividend payment by Halestorm, Inc., will be $1.56 per share. The dividends are anticipated to maintain a growth rate of 4 percent forever. If the stock currently sells for $29 per share, what is the required return percent?

3-Caan Corporation will pay a $2.98 per share dividend next year. The company pledges to increase its dividend by 5 percent per year indefinitely. If you require a return of 14 percent on your investment, how much will you pay for the company's stock today?

4-Tell Me Why Co. is expected to maintain a constant 5.4 percent growth rate in its dividends indefinitely. If the company has a dividend yield of 7.2 percent, what is the required return on the company's stockpercent ?

5-Moraine, Inc., has an issue of preferred stock outstanding that pays a $4.55 dividend every year in perpetuity. If this issue currently sells for $96 per share, what is the required return percent?

6-Bayou Okra Farms just paid a dividend of $3.70 on its stock. The growth rate in dividends is expected to be a constant 7 percent per year indefinitely. Investors require a return of 16 percent for the first three years, a return of 14 percent for the next three years, and a return of 12 percent thereafter. What is the current share price?

7-Lohn Corporation is expected to pay the following dividends over the next four years: $17, $13, $11, and $6.50. Afterward, the company pledges to maintain a constant 4 percent growth rate in dividends forever. If the required return on the stock is 12 percent, what is the current share price?

8-Synovec Co. is growing quickly. Dividends are expected to grow at a rate of 24 percent for the next three years, with the growth rate falling off to a constant 6 percent thereafter. If the required return is 14 percent, and the company just paid a dividend of $3.40, what is the current share price?

9-Secolo Corporation stock currently sells for $79 per share. The market requires a return of 9.6 percent on the firm's stock. If the company maintains a constant 2.8 percent growth rate in dividends, what was the most recent dividend per share paid on the stock?

10-You have found the following stock quote for RJW Enterprises, Inc., in the financial pages of today's newspaper.

|

52-WEEK

|

|

|

|

YLD

|

|

|

VOL

|

|

|

|

NET

|

|

HI

|

|

LO

|

STOCK (DIV)

|

%

|

PE

|

100s

|

CLOSE

|

CHG

|

|

88.12

|

|

|

|

46.72

|

|

|

RJW

|

1.70

|

|

2.0

|

|

15

|

|

|

18,507

|

|

|

??

|

|

-

|

.17

|

|

What was the closing price for this stock that appeared in yesterday's paper? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)

Yesterday's closing price $

If the company currently has 20 million shares of stock outstanding, what was net income for the most recent four quarters? (Enter your answer in dollars, not millions of dollars, e.g., 1,234,567. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)

Net income

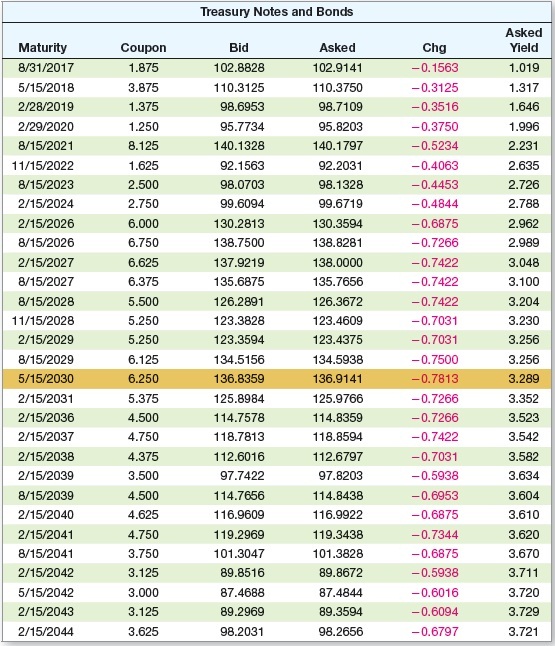

11-Locate the Treasury issue in Figure 7.4 maturing in February 2026. Assume a par value of $10,000.

What is its coupon rate? (Enter your answer as a percent rounded to 3 decimal places, e.g., 32.161.)

Coupon rate %

What is its bid price in dollars? (Do not round intermediate calculations. Round your answer to 2 decimal places, e.g., 32.16.)

Bid price $

What was the previous day's asked price in dollars? (Do not round intermediate calculations. Round your answer to 2 decimal places, e.g., 32.16.)

Asked price $

12- A Japanese company has a bond outstanding that sells for 91 percent of its ¥100,000 par value. The bond has a coupon rate of 5 percent paid annually and matures in 12 years.

What is the yield to maturity of this bond?

13- Say you own an asset that had a total return last year of 10.7 percent. If the inflation rate last year was 4.9 percent, what was your real return?

14- Bond X is a premium bond making semiannual payments. The bond pays a coupon rate of 11 percent, has a YTM of 9 percent, and has 15 years to maturity. Bond Y is a discount bond making semiannual payments. This bond pays a coupon rate of 9 percent, has a YTM of 11 percent, and also has 15 years to maturity. The bonds have a $1,000 par value.

What is the price of each bond today?

15- If interest rates remain unchanged, what do you expect the price of these bonds to be one year from now? In five years? In ten years? In 14 years? In 15 years?

16- Both Bond Sam and Bond Dave have 10 percent coupons, make semiannual payments, and are priced at par value. Bond Sam has four years to maturity, whereas Bond Dave has 17 years to maturity.

If interest rates suddenly rise by 2 percent, what is the percentage change in the price of Bond Sam and Bond Dave?

If rates were to suddenly fall by 2 percent instead, what would be the percentage change in the price of Bond Sam and Bond Dave?

17- Bond J has a coupon rate of 6 percent and Bond K has a coupon rate of 12 percent. Both bonds have 14 years to maturity, make semiannual payments, and have a YTM of 9 percent.

If interest rates suddenly rise by 2 percent, what is the percentage price change of these bonds?

What if rates suddenly fall by 2 percent instead?

18- Bourdon Software has 9.8 percent coupon bonds on the market with 18 years to maturity. The bonds make semiannual payments and currently sell for 107.7 percent of par.

What is the current yield on the bonds?

What is the YTM?

What is the effective annual yield?

19- Bond P is a premium bond with a coupon rate of 9 percent. Bond D has a coupon rate of 4 percent and is currently selling at a discount. Both bonds make annual payments, have a YTM of 6 percent, and have eight years to maturity.

What is the current yield for bond P and bond D?

If interest rates remain unchanged, what is the expected capital gains yield over the next year for bond P and bond D?

20-The YTM on a bond is the interest rate you earn on your investment if interest rates don't change. If you actually sell the bond before it matures, your realized return is known as the holding period yield (HPY).

a. Suppose that today you buy a bond with an annual coupon of 11 percent for $1,130. The bond has 18 years to maturity. What rate of return do you expect to earn on your investment? Assume a par value of $1,000.

b1. Two years from now, the YTM on your bond has declined by 1 percent, and you decide to sell. What price will your bond sell for?

B2. What is the HPY on your investment percent?