Reference no: EM13757971

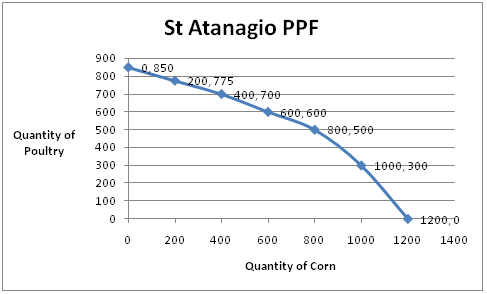

1. St Atanagio is a remote island in the Atlantic. The inhabitants grow corn and breed poultry. The accompanying table shows the maximum annual output combinations of corn and poultry that can be produced. Obviously, given their limited resources and available technology, as they use more of their resources for corn production, there are fewer resources available for breeding poultry.

|

Maximum annual output options

|

Quantity of Corn

(pounds)

|

Quantity of Poultry

(pounds)

|

|

1

|

1200

|

0

|

|

2

|

1000

|

300

|

|

3

|

800

|

500

|

|

4

|

600

|

600

|

|

5

|

400

|

700

|

|

6

|

200

|

775

|

|

7

|

0

|

850

|

Examine the following production possibility frontier graph with corn on the horizontal axis and poultry on the vertical axis illustrating these options and showing points 1-7.

a. Can St. Atanagio produce 650 pounds of poultry and 650 pounds of corn? Explain. Where would this point lie relative to the production possibility frontier?

b. What is the opportunity cost of increasing the annual output of corn from 800 to 1000 pounds?

c. What is the opportunity cost of increasing the annual output of corn from 200 to 400 pounds?

d. Can you explain why the answers to parts c. and d. above are not the same? What does this imply about the slope of the production possibility frontier?

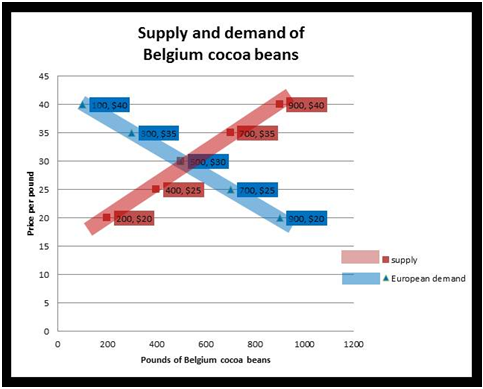

2. Suppose that the supply schedule of Belgium Cocoa beans is as follows:

|

Price of cocoa beans

(per pound)

|

Quantity of cocoa beans supplied

(pounds)

|

|

$40

|

900

|

|

$35

|

700

|

|

$30

|

500

|

|

$25

|

400

|

|

$20

|

200

|

Suppose that Belgium cocoa beans can be sold only in Europe. The European demand schedule for Belgium cocoa beans is as follows:

|

Price of Belgium cocoa beans

(per pound)

|

European Quantity of Belgium cocoa beans demanded

(pounds)

|

|

$40

|

100

|

|

$35

|

300

|

|

$30

|

500

|

|

$25

|

700

|

|

$20

|

900

|

a. Below is the graph of the demand curve and the supply curve for Belgium cocoa beans. From the supply and demand schedules above, what are the equilibrium price and quantity of cocoa beans from Belgium?

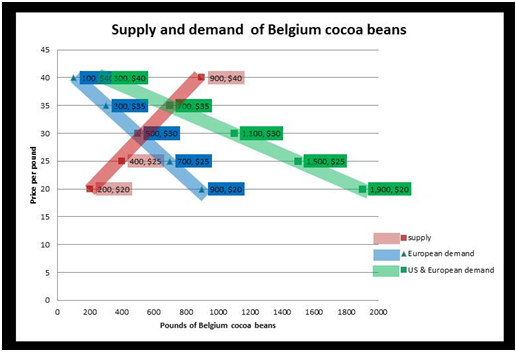

Now suppose that Belgium cocoa beans can be sold in the U.S. The U.S. demand schedule for Belgium cocoa beans is as follows:

|

Price of Belgium cocoa beans

(per pound)

|

U.S. Quantity of Belgium cocoa beans demanded

(pounds)

|

|

$40

|

200

|

|

$35

|

400

|

|

$30

|

600

|

|

$25

|

800

|

|

$20

|

1000

|

b. What is the combined demand schedule for Belgian cocoa beans that European and USA consumers buy?

|

Price of Belgium cocoa beans

|

U.S. Quantity of Belgium cocoa beans demanded

|

European Quantity of Belgium cocoa beans demanded

|

Total Demanded

|

|

(per pound)

|

(pounds)

|

(pounds)

|

(pounds)

|

|

$40

|

200

|

100

|

|

|

$35

|

400

|

300

|

|

|

$30

|

600

|

500

|

|

|

$25

|

800

|

700

|

|

|

$20

|

1000

|

900

|

|

Below is the supply and demand graph that illustrates the new equilibrium price and quantity of cocoa beans from Belgium.

c. From the supply schedule and the combined U.S. and European demand schedule, what will be the new price at which Belgium plantation owners can sell cocoa beans?

d. What price will be paid by European consumers?

e. What will be the quantity consumed by European consumers?

|

Last fiscal year

: The new freezer has more display and will increase the profits attributable to frozen foods by 30 % Profits for that department were $5,000 in the last fiscal year. The company cost of capital is 9%. Ignoring taxes what should the firm do? Suggest..

|

|

An overview of the system or software application

: System and Application Overview: An overview of the system or software application an intended users, Requirements Specification: Detailed requirements specification with both functional and nonfunctional requirements

|

|

Description of the website''s perceived goal

: Name of the website and URL where digital media project can be posted, Description of the website's perceived goal

|

|

Inflation unemployment debt income distribution

: Assume the role of a manager who has been tasked with preparing a country brief for your senior level executives trying to determine if the country is appropriate for foreign direct investment.

|

|

What will be the quantity consumed by european consumers

: What is the opportunity cost of increasing the annual output of corn from 800 to 1000 pounds and what is the opportunity cost of increasing the annual output of corn from 200 to 400 pounds?

|

|

Maturity risk premium for the security

: The real risk-free rate is 3%, and inflation is expected to be 3% for the next 2 years. A 2-year Treasury security yield 6.3%. What is the maturity risk premium for the 2-year security?

|

|

Identify the specific components of an institution

: Identify the specific components of an institution. Explain why the institutions in failed states are in such disarray.

|

|

Explain qualitative and mixed method approaches

: In this course you have explored Quantitative, Qualitative and Mixed Method approaches to research. Consider the research question you wrote.

|

|

Benefits of the wireless local area network

: What are primary benefits of the wireless local area network (WLAN)-based mobile computing system and wearable monitoring devices

|