Reference no: EM131235319

Energy Economics

Problem Set 1

1. You run a venture capital fund that is considering an investment in the newly dereg- ulated power market in Baja California. Baja has a small market with two utilities that are both selling off their generation assets. Both utilities have identical generation portfolios. The new power market will set prices according to the intercept of supply and demand. The supply curve will be determined by the registered marginal cost of every generator in the market. Those costs (for one utility) are given in the table below.

Table 1: Generation portfolio of Utility 1 (same as Utility 2)

Tech Capacity MC

Coal 1000 $10

Gas CC 750 $30

Gas CT 250 $50

Demand in the Baja market follows two levels, peak and off-peak and is perfectly inelastic. Assume that in one year there are 5000 off-peak hours and 5000 peak hours. Demand in the peak hours is 3700 MW and in the off-peak it is 1500 MW. Prices are set at the intersection of demand and the aggregate market supply curve. If there is a tie in the cost of generation (between two firms) when setting the market price, the quantities are evenly divided between the two portfolios. For example if demand were 500 MW, the price would be $10 (the MC of the coal plants) and each firm would sell 250 MW. Assume that generators cannot exercise market power.

(a) What will be the on peak and off-peak prices in this market?

(b) You are offered the opportunity to lease one of the above generation portfolios for one year. This means you will earn revenues according to the market clearing prices in 5000 off-peak and 5000 peak hours. How much would you be willing to pay for this lease (in other words, what is the expected annual producer surplus for one of these portfolios)?

(c) In the above market, you have a chance to invest in a new solar plant that would only operate during peak hours. The capital cost of the technology is $215,000 per MW of capacity. Unfortunately it is flimsy technology that will only last one year. The marginal cost of a solar plant is zero. Prices will be set according to the intersection of supply and demand using the same approach as before. How much solar capacity would you add to this market? Explain your expected net profit from this investment.

(d) Would your answer change if the solar could somehow also operate during off-peak as well as peak hours?

Returning again to the newly deregulated Baja market, consider that your pricing might not be constrained to equal MC. In other words it may be possible to exercise market power. You have purchased the portfolio of utility 1. You know that the second portfolio was purchased by a non-profit charity that wants to offer its supply at marginal cost, even if that doesn't maximize its profit. Given your expectation of supply at MC for the other firm, draw the residual demand your firm would face in peak hours in the space below.

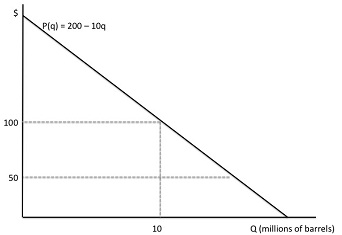

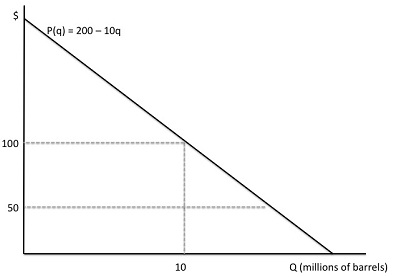

2. In California, the marginal cost of producing oil is $50 a barrel. Demand for oil (in millions of barrels per year) in California is linear, of the form D(p) = 20 - 1 ∗ p or an inverse demand of p = 200 - 10q. This week we will assume there is an unlimited

supply of oil (no scarcity) at $50 a barrel.

(a) If all California oil were under the control of a single monopolist, what is the profit maximizing quantity for that monopolist to produce?

(b) What is the deadweight loss from the market power in the California Oil market?

Provide both a graphic and numerical answer

(c) Now assume that California has limited production capacity and can produce at most 4 million barrels a year (still at a constant MC of $50 a barrel). Given this new production constraint, what is the monopoly price of Oil in California? What is the DWL from market power? Illustrate your answer with a graph.