Reference no: EM131245602

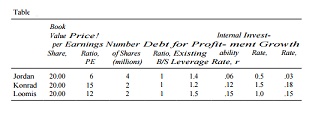

The Jordan Corporation is a manufacturer of heavy-duty trucks. Because of a low internal profitability rate and lack of favorable investment opportunities in the existing line of business, Jordan is considering merger to achieve more favorable growth and profitability opportunities. It has made an extensive search of a large number of corporations and has narrowed the candidates to two firms.

The Konrad Corporation is a manufacturer of materials handling equipment and is strong in research and marketing. It has had higher internal profitability than the other firm being considered and has substantial investment opportunities.

The Loomis Company is a manufacturer of food and candies. It has a better profitability record than Konrad. Data on all three firms are given in Table Q20.3. Additional information on market parameters includes a risk-free rate of 6% and an expected return on the market, E(R„,), of 11%. Each firm pays a 10% interest rate on its debt. The tax rate, of each is 40%. Ten years is estimated for the duration of supernormal growth.

a) Prepare the accounting balance sheets for the three firms.

b) If each company earns the before-tax r on total assets in the current year, what is the net operating income for each company

c) Given the indicated price/earnings ratios, what is the market price of the common stock for each company?

d) What will be the immediate effects on the earnings per share of Jordan if it acquires Konrad or Loomis at their current market prices by the exchange of stock based on the current market prices of each of the companies?

e) Compare Jordan's new beta and required return on equity if it merges with Konrad with the same parameters that would result from its merger with Loomis.

f) Calculate the new required cost of capital for a Jordan-Konrad combination and for a Jordan-Loomis combination, respectively.

g) Compare the increase in value of Jordan as a result of a merger at market values with the cost of acquiring either Konrad or Loomis if the combined firms have the following financial parameters:

|

Describe the various forms that economic integration

: Briefly describe the various forms that economic integration can take (e.g., customs union, free-trade areas). What are the major obstacles to effective economic integration in developing regions?

|

|

What issues form the basis of debate between trade optimist

: Explain some of the arguments in support of the use of tariffs, quotas, and other trade barriers in developing countries ? What issues form the basis of the debate between trade optimists and trade pessimists? Explain your answer.

|

|

Why have the results often not lived up to expectations

: Explain the theoretical and practical arguments in support of import substitution policies. What have been some of the weaknesses of these policies in practice, and why have the results often not lived up to expectations?

|

|

What are benefits and consequences for conducting training

: Make a final decision on the content or skills to train your learners on. Choose a subject that will allow you to gauge their performance before and after the training you have completed. Why does this training need to be done? What are the benefi..

|

|

What will be the immediate effects on the earnings per share

: What will be the immediate effects on the earnings per share of Jordan if it acquires Konrad or Loomis at their current market prices by the exchange of stock based on the current market prices of each of the companies?

|

|

What are the possibilities advantage of export promotion

: What are the possibilities, advantages, and disadvantages of export promotion in developing nations with reference to specific types of commodities (e.g., primary food products, raw materials, fuels, minerals, manufactured goods)?

|

|

How large a credit line should hammarlund request

: Ending cash in September is $100,000 (and, thus a notes payable balance of $1,900,000 is on the books at that time). How large a credit line should Hammarlund request from its Bank

|

|

What factors have limited the benefits

: In what ways is the emergence of China as the "workshop of the world" an opportunity for other developing countries, and in what ways is it a threat?

|

|

Critics of international trade from developing countries

: Critics of international trade from developing countries sometimes claim that present trading relationships between developed and underdeveloped countries can be a source of "antidevelopment" for the latter and merely serve to perpetuate their wea..

|