Reference no: EM13333043

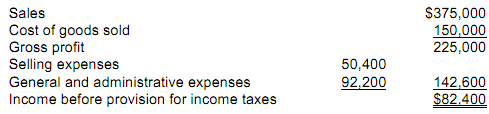

1. Clockworks Inc. is a small Canadian company that has been marginally successful over the past 5 years. Its net income for the year ended December 31, 20x12, as determined under Accounting Standards for Private Enterprises (ASPE) is as follows:

Additional information for the year:

- Selling expenses include:

o Meals & Entertainment - $2,300

o Donation to a registered charity - $500

o Sponsorship of local, junior hockey team - $2,500

- General and administrative expenses include:

o Penalty for filing income tax late - $500

o Administration fees related to arranging new debt - $2,200

- Cost of Goods Sold expenses include:

o Depreciation of manufacturing equipment - $22,500

- Capital cost allowance on tangible assets was calculated to be $16,250 for the year

- Clockworks Inc. has a non-capital loss carry-forward of $15,000 from 20x10

- Assume that Clockworks Inc. claims the maximum allowable CCA

Based on the information provided, what is Clockworks Inc.'s 20x12 net income for tax purposes?

a. $95,060

b. $92,560

c. $92,060

d. $77,560

2. Based on the information provided above, Clockworks Inc.'s taxable income will be $_________ __________ than its net income for tax purposes?

a. $18,000 lower

b. $ 3,000 lower

c. $15,500 higher

d. $15,500 lower

3. Better Bottles Inc. commenced operations on January 1, 20x9 when it purchased a patent for a recycling process that takes used food containers and converts them into plastic water bottles. Better Bottles Inc. purchased the patent for $120,000. At the time of purchase, the patent had a remaining legal life of 20 years. Also on January 1, 20x9, Better Bottles Inc. signed a lease for its manufacturing facility. The lease had a 5-year term with 3, 2-year renewal options. Better Bottles Inc. has a December 31st year-end.

In 20x9, Better Bottles Inc. spent $100,000 to customize the manufacturing space. In 20x11, an additional $80,000 was spent on creating custom office space within the manufacturing facility.

Assuming Better Bottles Inc. claims the maximum allowable CCA in all years, what is the UCC balance of the patent and the leasehold improvements respectively at the end of 20x12?

a. $44,296, $105,999

b. $96,000, $105,999

c. $44,296, $112,856

d. $96,000, $112,856

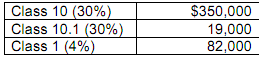

4. Big Dave's Delivery had the following opening UCC balances for the current taxation year.

During the current year two delivery trucks (Class 10) were sold for proceeds of $20,000 (original cost - $41,000) and $15,000 (original cost - $52,000). The trucks were replaced with a single new, bigger truck purchased at a cost of $62,250. In addition, Big Dave sold his Porsche for $25,000 (original cost - $59,000) and replaced it with a BMW SUV, which had a cost of $62,000.

Based on this information, what is the maximum CCA that Big Dave's Delivery can claim for the current taxation year?

a. $119,718

b. $110,868

c. $118,818

d. $124,518

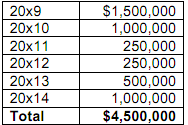

5. In 20x9, Hartland Farms Inc. sold 50 acres of vacant land to a commercial development company for $4,500,000. Hartland Farms Inc. purchased the land 50 years ago for $250,000. Expenses incurred by Hartland Farms Inc. on disposition of the land were 3.5% of the selling price (including legal fees of 1.5% and sales commissions of 2%). The commercial development company did not have the cash to pay the full sales price on the date of acquisition and therefore agreed to pay based on the following payment schedule:

What taxable capital gain was recorded by Hartland Farms Inc. in 20x11?

a. $1,250,486

b. $431,986

c. $113,680

d. $353,717

6. Stark Enterprises Inc. is a Canadian Controlled Private Corporation with an opening RDTOH balance of $30,000 in 20x12. In 20x12, Stark Enterprises reported aggregate investment income of $50,000, not including dividends from shares Stark Enterprises holds in an unconnected CCPC of $6,200. Investments are made with idle cash and considered passive, portfolio investments. Stark Enterprises Inc. paid dividends of $40,000 and $45,000 to its shareholders in 20x11 and 20x12 respectively. What is the 20x12 ending balance in the RDTOH Account?

a. $22,069

b. $30,400

c. $33,721

d. $32,067

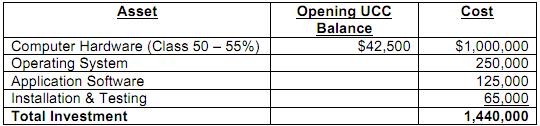

7. In 20x12, Dynamic Energy Consulting made a significant capital investment to upgrade its existing technology platform. The upgrade included investments in the following:

The new computer hardware has an expected useful life of 7 years and an estimated disposal value of $25,000. To help offset the cost of the new technology; Dynamic Energy sold their existing computer hardware for $20,000 (original cost - $400,000). Assuming that Dynamic Energy Consulting claims the maximum available CCA for tax purposes, how much CCA will be claimed in 20x12?

a. $413,875

b. $504,500

c. $424,125

d. $442,000

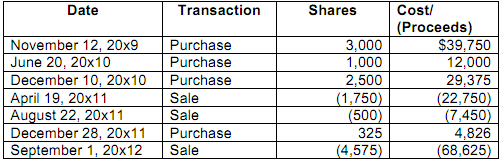

8. Nerd Herd Inc. is a Canadian company that implements ERM software systems. Over the past several years, Nerd Herd has generated some idle cash, which it has invested in an unrelated Canadian computer company in order to earn a return, while waiting for investment opportunities. In 20x12, Nerd Herd needed cash so it disposed of its investment. Below are Nerd Herd's investment transactions over the past several years:

Given Nerd Herd has a December 31st year end, what will be the amount of its taxable capital gain/(loss) in 20x12 related to the sale of this investment?

a. $6,437

b. $5,378

c. $5,763

d. $Nil, capital gains earned on the sale of Canadian company stocks are tax exempt

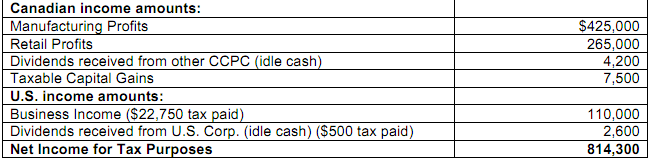

The Stork Company is a CCPC that designs and manufactures baby products including swaddling blankets, baby clothes, diaper bags and play gyms. These baby products are primarily sold in The Stork Company's retail store, ‘Stork-ins'. In addition to Stork Company products, Stork-ins also retails a wide range of other baby merchandise purchased wholesale from various manufacturers in Canada and abroad. The Stork Company also sells its products to other retailers in Canada and the United States.

The Stork Company's most recent financial information for the 20X12 tax year follows:

In 20x12, The Stork Company has a non-capital loss carry forward from 20x10 of $40,000. This year, the company donated $4,500 to various registered children's charities.

The company has determined that 80% of its net taxable income is earned in Canada.

9. Calculate The Stork Company's 20x12 taxable income.

a. $809,800

b. $769,800

c. $765,600

d. $742,350

10. For purposes of this question, assume that the taxable income is $325,000. Calculate The Stork Company's Federal Part I tax payable (excluding any additional Refundable Tax) for 20x12 using the following tax rates:

Basic Federal tax - 38%

Abatement - 10%

Small Business Deduction - 17%

Manufacturing and Processing - 13%

General Rate reduction - 13%

a. $21,797

b. $22,297

c. $20,484

d. $45,047