Reference no: EM131529895

Question: Human Genome Sciences, Inc., a biopharmaceutical company, discovers, develops, and markets new gene and protein-based drugs. Its 1998 annual report showed property, plant, and equipment net of accumulated depreciation of $20,965,000 with total net assets of S244,247,000. A note on operating leases revealed the following:

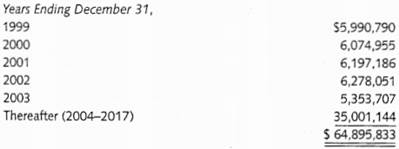

Operating Leases 1 The Company leases office and laboratory premises and equipi merit pursuant to operating leases expiring at various dates through 1 2017. The leases contain various renewal options. Minimum annual rentals are as follows:

Required: a. Assume that the companys cost of capital is 10 percent and that operating lease planets between 2004 and 2017 are equal amounts per year. By how much would Human Genome Sciences' property, plant, and equipment and its total net assets increase by on December 31,1998 if these leases were capitalized?

b. Assume that the company net income for 1998 was $20 million. What was its return on assets (ROA) (a) before and (b) after capitalizing the operating leases? Use straight-line depreciation over 14 years for the capitalized leases. Operating lease expense for 1998 is $5,900,000.