Reference no: EM131058908

Individual Assignment: Short Answer Questions- based on Economic Theory

Part 1: Firm Perspective

Read the below two sources below and then answer the questions.

Source 1: Competitive dynamics in the banking sector

The Treasury presentation earlier in the week to the Senate inquiry on competition in the banking sector drew attention to a number of significant developments which have, collectively, altered the competitive dynamics of the retail banking sector in recent years.

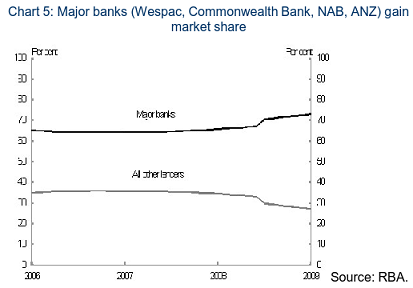

..the four major banks [in Australia] have expanded their collective market share across a range of loan and deposit products.

This is illustrated in the home loan market (Chart 5). The share of total housing loan credit for the five largest banks - the four major banks (Commonwealth Bank, NAB, ANZ and Westpac) plus St George - has increased from around 60 per cent before the onset of the GFC in mid-2007 to around 73 per cent.

Source: https://www.treasury.gov.au/PublicationsAndMedia/Publications/2011/Economic-Roundup-Issue-1/Report/The-Australian-banking-system-challenges-in-the-post-global-financial-crisis-environment

Source 2: Collusion for Illusion (Opinion Piece)

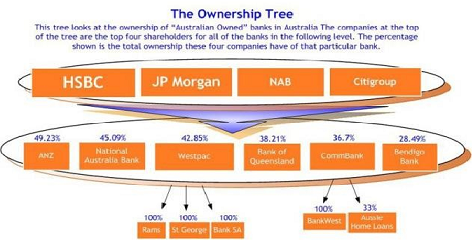

Australia's Big 4 promote competitiveness amongst themselves when they are all owned by the same financial (mostly foreign) interests

So what do Australia's "Big 4″ have in common besides siphoning all our money into their coffers? NAB, ANZ, Westpac & Commonwealth Bank are publicly listed companies. So that means they have shareholders right? Well did you know that the top 4 shareholders in each of the "Big 4″ are in fact the same?

...They would have you believe that they're all competing with each other and in that spirit of competitiveness give you the power to choose a product best suited for you over the others. This power never existed. Well, that's not totally accurate. You were given the illusion of power. ...The big banks are in fact colluding in order to retain the power you thought you had...

Source: https://realnewsaustralia.com/2013/07/01/collusion-for-illusion/

1. Read the above articles and answer the following questions:

a) In your opinion, what type of market structure do Australian Banks operate in? Justify your answer with reference to the above article, research and theory.

b) Critically compare a collusive oligopoly market structure with perfect competition in terms of price, output, allocative efficiency and consumer and producer surplus. Support your analysis with economic theory and graphs.

c) Are there any situations where a market structure with less competition has some benefits? Why or why not? Briefly explain your answer with reference to at least two sources.

You may want to consider the following source: https://economicstudents.com/2013/07/why-did-our-banks-survive-the-gfc/

2. In a perfectly competitive market for apples explain would happen in the short-run to the market and to individual producers if the price for pears went up. Demonstrate your answer using a diagram. With reference to the same diagram show what would happen to the market and individual producers in the long-run.

Part 2: Macroeconomic Perspective

Consider the sources below from 2014 and answer the following questions:

Source 1: Spanish Growth Quickens, Says Central Bank

Bank of Spain Raises Its Economic Forecasts for This Year and Next By David Román Updated July 23, 2014 8:06 a.m. ET

MADRID-Spain's economy grew at its fastest pace in six years during the second quarter, in contrast to the rest of the euro zone where growth appears to have stalled.

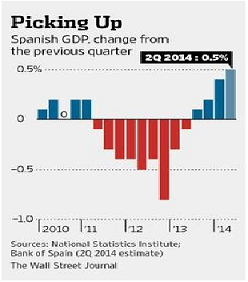

The Bank of Spain said Wednesday that Spanish gross domestic product likely expanded 0.5% in the second quarter, compared with the first, up from 0.4% growth recorded in the first quarter. The growth figure is the first official estimate for the three months from April to June.

Spain doesn't release annualized growth estimates. According to The Wall Street Journal's calculations, the euro zone's fourth-largest economy grew at an annualized pace of 2% in the second quarter.

Economists say this level of growth is likely to make Spain the best or one of the best economic performers in the euro zone in the quarter, largely due to a series of effective economic reforms and because of a rebound effect after a long economic slump.

...But observers also caution that Spanish growth may be peaking, as the export-led recovery is in danger of petering out in the absence of a clear improvement in the global economy.

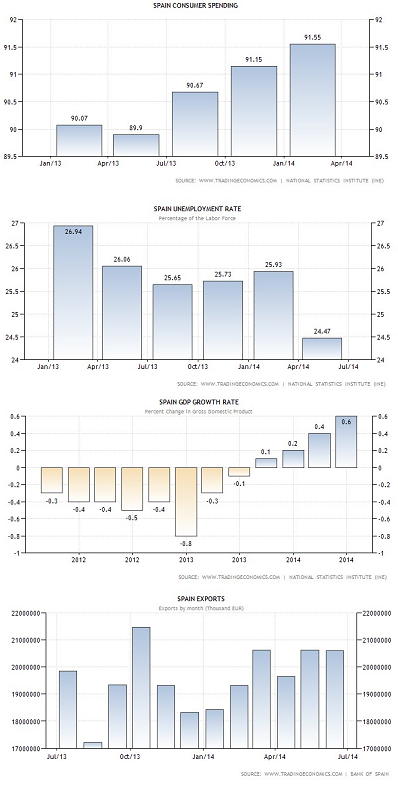

Jennifer McKeown, an economist at Capital Economics, said that a higher contribution to Spanish growth from domestic consumption in recent quarters, after years in which companies and households have focused on paying back debt, may not be enough to sustain current expansion rates.

"Given sky-high unemployment with an unemployment rate of 24.47%, the risk of deflation and the fact that public and private-sector deleveraging has further to run, a recovery led by domestic spending seems unsustainable, "Ms McKeown said. "While Spain is set to be one of the euro-zone's best performers this year, with GDP rising by 1% or a bit more, the recovery could yet prove to be short-lived."

The Bank of Spain said a gradual recovery in domestic consumption led to a faster-than-anticipated economic rebound. It added that it now anticipates that Spain's economy will grow 1.3% in 2014 and 2% in 2015, slightly above earlier projections of 1.2% and 1.7%, respectively.

Spain exited a two-year recession in the second half of last year, and has since been one of the strongest-performing euro-zone economies, buoyed in particular by soaring exports.

Source: https://online.wsj.com/articles/spanish-economy-picked-up-pace-in-second-quarter-1406107241

Source 2: Trading Economics Graphs

Source: https://www.tradingeconomics.com/spain/indicators

1. Us the above sources and some limited research to answer the following questions.

a) Based on the article and graphs above what phase of the business cycle do you believe Spain was in during 2013? Explain why with reference to theory and represent this phase of the business cycle using an aggregate demand and supply model.

b) Based on the article and graphs above what phase of the business cycle do you think Spain has entered in 2014? Why? Use your aggregate demand and supply model from part a) to demonstrate what happened to the economy in 2014.

c) Given Spain's most recent unemployment rate, if 17,353,000 people were currently employed how many people would be unemployed?

2. Read the article below from 2016 and answer the following questions:

India still fastest-growing economy in world gripped by uncertainty: IMF Apr 13, 2016, 03.33AM IST

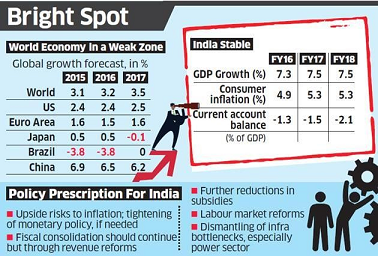

NEW DELHI: The International Monetary Fund (IMF) retained India's GDP forecast for this fiscal year and the next, confirming its status as the world's fastest-growing major economy, as it pared global expansion estimates citing weakening worldwide recovery amid increasing financial turbulence.

India's growth in FY17 and FY18 was pegged at 7.5% in the World Economic Outlook (WEO), the Fund's flagship publication, unchanged from January.

"Growth will continue to be driven by private consumption, which has benefited from lower energy prices and higher real incomes," WEO said. "With the revival of sentiment and pickup in industrial activity, a recovery of private investment is expected to further strengthen growth," it said of India, in contrast to the gloomy outlook for rest of the world. The global economy is expected to grow 3.2% in 2016, only marginally ahead of 3.1% in 2015 and down 0.2 percentage point from the 3.4% forecast in January.

"Global growth continues, but at an increasingly disappointing pace that leaves the world economy more exposed to negative risks. Growth has been too slow for too long," said IMF economic counsellor Maurice Obstfeld, calling for an "immediate, proactive response" in a statement.

...INDIA STABLE IMF's long-range forecast sees India growing at 7.8% in FY22, well ahead of others and still the most rapidly accelerating major economy. "Sustaining strong growth over the medium term will require labour market reforms and dismantling of infrastructure bottlenecks, especially in the power sector," it said.

Lower commodity prices, a range of supply side steps, and a relatively tight monetary policy have yielded a faster-than-expected slowing of inflation, the IMF said, creating room for rate cuts. However, it cautioned that the "upside risks to inflation" could require tightening of monetary policy. The Reserve Bank of India cut the key rate by 0.25 percentage point last week,

India should achieve its 5% consumer inflation target in the first half of 2017, the IMF said, while flagging poor monsoons and the pay commission wage award as risks. To be sure, the India Meteorological Department forecast an above-normal monsoon this year on Tuesday. The IMF also called for continued fiscal consolidation through revenue reforms and reductions in subsidies.

Source:https://economictimes.indiatimes.com/news/economy/indicators/india-still-fastest-growing-economy-in-world-gripped-by-uncertainty-imf/articleshow/51796401.cms

a) Based on the above article what phase of the business cycle is the Indian economy experiencing in 2016? Justify your answer with reference to economics theory and support your analysis with a graph showing where the Indian economy is operating.

b) How would the falling energy costs affect the Indian economy in 2016? Why? Show this effect in your graph from a).

c) What macroeconomic indicator should be monitored closely in India in 2016? What can the Reserve bank of India do to control this indicator?

Do not forget to include a reference list for any sources apart from lectures or tutorials. You also need to include in text references. A referencing guide is available on the portal under assessments. Both of these will count for.